How to Choose B2B Crypto Exchange Provider

Choosing the right B2B crypto exchange provider directly impacts security, scalability, and revenue. This guide breaks down essential criteria, common risks, and practical steps to help businesses select a reliable exchange partner that supports long-term growth.

As of 2026, the market offers more than 200 crypto exchanges [1]. Some cater only to individual users, while others boost revenue through B2B partnerships. In the first half of 2025, the total trading volume across exchanges reached $9.36 trillion [2]— the highest first-half result since 2021. The global demand for crypto exchange services clearly remains high.

In this article, we’ll explore how to choose a B2B crypto exchange provider that aligns with your product goals and long-term strategy. We’ll break down the core criteria that matter most for businesses — including Security (KYC/AML), Regulatory Compliance, Liquidity quality, Scalability, Reliable Trading Engine performance, and 24/7 Support. We’ll also discuss how to match a provider’s capabilities to your target audience (retail or institutional), what customization options to look for, and how to evaluate a provider’s experience and track record to avoid unnecessary risks. By the end, you’ll have a practical framework for selecting a partner that can help your business grow rather than limit it.

To stay in touch, follow us on X .

Why choosing the right crypto exchange partner matters for business

A poor choice of provider can directly impact your bottom line. Slow, unstable, or unpredictable exchange operations drive customers to competitors. The major risks for companies include:

- Technical failures on the provider’s side

Resulting in transaction delays, overwhelmed support teams, and unsatisfied users. - Security weaknesses

The crypto sector remains vulnerable to scams and breaches. Working with a provider that does not comply with KYC/AML standards or licensing requirements risks both customer funds and your company’s reputation. - Limited scalability

If the exchange cannot keep up with your product expansion, constant workarounds become expensive and slow down growth.

How B2B needs differ from individual traders

A typical retail user expects a crypto exchange to be simple and fast to use — a clean interface, quick execution, and full transparency with no hidden fees or unpredictable price swings.

For B2B clients, expectations go far beyond a smooth user interface. Along with strong security, businesses rely on an exchange to deliver stable liquidity, stay compliant with regulations, react quickly if any technical issues occur and, of course, profit management. Most importantly, the platform should offer the tools and features that fit the company’s specific business model — not the other way around.

We’ll break these requirements down in the following sections.

Step 1: Define your business goals and requirements

Identify your business type

- Crypto company: wallet, payment provider, fiat on/off-ramp

- Fintech platform (Web2 / Web3)

- Media platform or online community with crypto demand

- Any website/app with active traffic and monetization opportunities

- Startup building an exchange product

Define essential capabilities

- Fiat on/off-ramps

- P2P trading

- API performance and uptime

- Liquidity

- Scalability

- 24/7 support

- Number of assets and supported networks

Compliance requirements

- KYC/AML standards

- Relevant licenses

- Local regulatory compliance

Match requirements to your audience

Your priorities will differ depending on whether your business serves retail users, advanced traders, or institutional partners. Retail users require simplicity and predictable UX, while institutions need strict compliance, auditability, liquidity depth, and advanced execution tools.

Trading engine performance

A reliable trading engine is essential in B2B partnerships: look for low-latency execution, predictable order routing, throughput capacity, and a tested system for high-load events. Poor execution speed or unstable matching dramatically affects conversion, spreads, and partner trust.

If you're considering building your own platform instead of integrating an exchange API, check out our guide: "How to create a crypto exchange platform".

Step 2: Evaluate reputation

Proven B2B experience

Where to check:

- company website

- news features

- partner listings

- case studies

- public announcements

User and partner reviews

Where to check:

- Trustpilot — understanding the end-user experience

- G2 — insights specifically from B2B clients

ChangeNOW’s page on Trustpilot. Check if the reviews of providers are real and fresh.

NOWPayment’s page on G2.

Longevity and market stability

Where to check:

Media reports on hacks, outages, withdrawal freezes. Lifehack: you can check media listicles like ‘6 affiliate programs driving B2B crypto growth in 2025’ or others to collect the best providers.

Company age, major partnerships, and social presence.

User-generated content — tags and real customer feedback reveal more than polished claims.

Step 3: Functionality, technology, and integrations

Key requirements:

Supported assets and liquidity. A solid baseline for B2B: 50–300 liquid assets, all major stablecoins, and core fiat pairs.

Technology stack and API quality

How to check:

Request API documentation → run latency and stability tests in sandbox → test real user flows. If needed, ask for a third-party security review — companies like CertiK provide such audits.

Scalability under real-world load

How to check:

Ask for benchmarks: maximum TPS, peak-time execution stability, and how the system handles liquidity spikes. Scalable architecture ensures your operations won’t stall as user demand grows.

Unified ecosystem capabilities

(wallet, custody, payment gateways aligned in one infrastructure)

This simplifies:

- settlements (no cross-provider transfers)

- compliance and security controls

- issue resolution with a single point of support

Institutional-grade features (if relevant)

If you work with institutional clients, verify support for higher transaction limits, enhanced risk monitoring, audit logs, and advanced settlement workflows.

White-label and customization options

Ask directly:

- Can UI/UX, branding, and fiat gateways be customized?

- Is custom domain hosting available?

- Can trading flows be tailored?

- Can we review a demo and the provider’s roadmap?

Step 4: Security, regulation, and compliance

In recent years, the security landscape in crypto has improved, yet incidents still occur even among major industry players. Several regional centralized exchanges have been hacked, including Japan’s DMM Bitcoin (USD 305 million) [3] and India’s WazirX (USD 235 million) [4]. As a result, many countries continue to tighten their regulatory and security requirements.

When evaluating a crypto service provider, we recommend relying on the guidelines set by the FATF — an international organization that protects the integrity of the global financial system. Watch the video below to learn about financial security measures:

So, the FATF guidelines include:

KYC procedures

To verify identity, screen sanction lists, block high-risk jurisdictions, and enable investigations of abnormal behavior.

Regulatory compliance standards

Depending on your jurisdiction, providers may need to support Travel Rule compliance, reporting obligations, sanctions screening, and automated fraud detection. Ensure the provider can adapt to your regulatory environment and provide documentation for audits when necessary.

Continuous transaction monitoring

To detect:

- money laundering

- terrorist financing

- suspicious large transfers

Reports must be filed with regulators when necessary, according to AML laws.

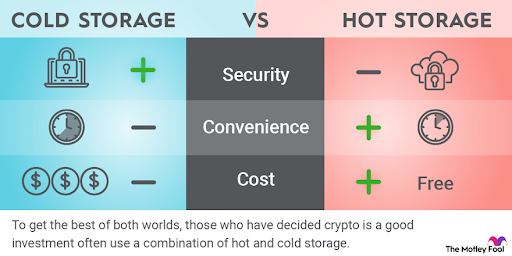

Cold storage security

Reputable exchanges keep most customer assets offline in secure vault environments. Storing funds in a cold wallet adds an extra layer of protection, keeping assets out of reach for hackers who might try to break into online wallets using malware, viruses, or other tricks.

Main differences between Cold and Hot Storage [5]

Support and maintenance

Support and maintenance are crucial not only during the initial launch but throughout the entire lifecycle of the service. Because crypto businesses operate internationally, time zone differences can become a significant factor — especially when transaction-related issues occur. We recommend working only with providers that ensure:

- 24/7 technical support

- Regular software updates with proactive communication about planned changes during negotiations

Step 5: Pricing transparency and partnership terms

Clarify what’s included in integration costs — and what counts as add-ons:

| Solution | Price |

|---|---|

| Full custom exchange development | $130,000–$200,000+ |

| White-label exchange | $10,000–$50,000+ |

| Crypto Exchange API | service fees: 0.4–0.8% |

| Telegram Exchange Bot | service fees: 0.4–0.8% |

| Crypto Exchange Widget | service fees: 0.4–0.8% |

Possible additional fees

- support tiers

- customization

- enhanced security

- listing new assets and networks

Institutional pricing considerations

For institutional clients, check whether the provider offers volume-based discounts, custom liquidity routing rules, or tailored settlement terms. Transparent pricing is essential for forecasting operational costs and long-term business viability.

5 Red Flags to Avoid

- No transparency on licensing and regulation → High legal and operational risk.

- No public SLA or uptime guarantees → Downtime will become your problem.

- Hidden fees → Difficult to even roughly predict revenues.

- Low liquidity and slow execution → Lost users, lost transactions, lost profit.

- Lack of institutional support features → No SLAs, no audit logs, no advanced monitoring — not suitable for high-volume partners.

Summary

Beyond the technical and security aspects, the choice depends on what matters most for your business. Some companies prioritize marketing capabilities, others require fast integration and continuous product upgrades.

A good approach:

- Select 5 providers that match your core requirements

- Request commercial proposals

- Shortlist 2 finalists

- Choose the one with better communication and teamwork

At the end of the day, business is built with people. You should feel confident in the partner responsible for the financial experience your customers rely on. Your exchange provider must scale with you — helping you grow, not holding you back.