Sei vs Solana: Which One Is More User-Friendly?

Compare Sei and Solana on transaction speed, finality times, fees, and ecosystem strengths⛓️Choose between trading-optimized and consumer-scale blockchain

As blockchain technology continues to shape industries from finance to gaming, selecting the right platform has never been more crucial. For traders, developers, and creators alike, understanding the ins and outs of top contenders like Sei and Solana can make all the difference.

In this 2025 comparison, we’ll dive into the differences between Sei and Solana, focusing on key aspects like transaction speed, fees, developer tools, and user experience. Whether you’re interested in DeFi, NFTs, or high-frequency trading, we’ll guide you in selecting the platform that best fits your needs.

Glossary of Terms

Here's a quick guide to some key terms used in this article.

TPS (Transactions Per Second): This refers to the number of transactions a blockchain can process per second. The higher the TPS, the more users and operations the network can support simultaneously.

Finality: The point at which a transaction is considered confirmed and irreversible. Faster finality means users can trust that their transactions are complete almost instantly.

Cross-chain bridges: Technologies that allow assets to be transferred between different blockchains, enhancing interoperability. They enable users to move assets seamlessly across multiple networks.

EVM (Ethereum Virtual Machine): A decentralized computation engine that allows developers to build smart contracts and decentralized applications (dApps) on the Ethereum network. Other blockchains that support EVM can run Ethereum-based dApps.

CosmWasm: A smart contract platform built for the Cosmos ecosystem, enabling developers to write contracts in Rust. It allows the ecosystem to have interoperable smart contracts across different blockchains.

Proof of Stake (PoS): A consensus mechanism where participants validate transactions based on the number of coins they hold and willing to "stake" as collateral. PoS is considered more energy-efficient compared to Proof of Work (PoW).

When it comes to Sei vs Solana, each platform stands out for different reasons. This comparison highlights the key differences between Sei and Solana, showing how each platform caters to different use cases and user needs.

Key Takeaways

- Sei is optimized for trading – ultra-fast finality, EVM & CosmWasm support, low fees.

- Solana is ideal for consumer applications – high throughput, higher transaction volume capabilities, and wide adoption.

- Both platforms are open-source with active GitHub repositories Sei GitHub & Solana GitHub.

- Developers can use multiple languages. Sei allows developers to use Solidity (for EVM-based smart contracts) and Rust (for CosmWasm), while Solana primarily relies on Rust for smart contracts, but also supports C/C++ for program development.

Quick Comparison: Sei vs Solana

| Criterion | Sei | Solana |

|---|---|---|

| Transaction Finality | ~400 ms [1] | ~2.5-4.5 seconds [2] |

| Theoretical Max TPS | Up to 200,000 (in controlled testnet environments) [1] | 65,000+ [2] |

| Transaction fees | Ultra low ($0.001-$0.1) | Extremely low (<$0.0025) |

| Developer Tools | EVM & CosmWasm, SDKs | Rust & Anchor, extensive ecosystem |

| Official wallet | Sei Global Wallet | Phantom, Trust, Solflare, Backpack and ChangeNOW |

| Best for | Trading, DEXs, HFT | Gaming, NFTs, Consumer dApps |

What Is Sei?

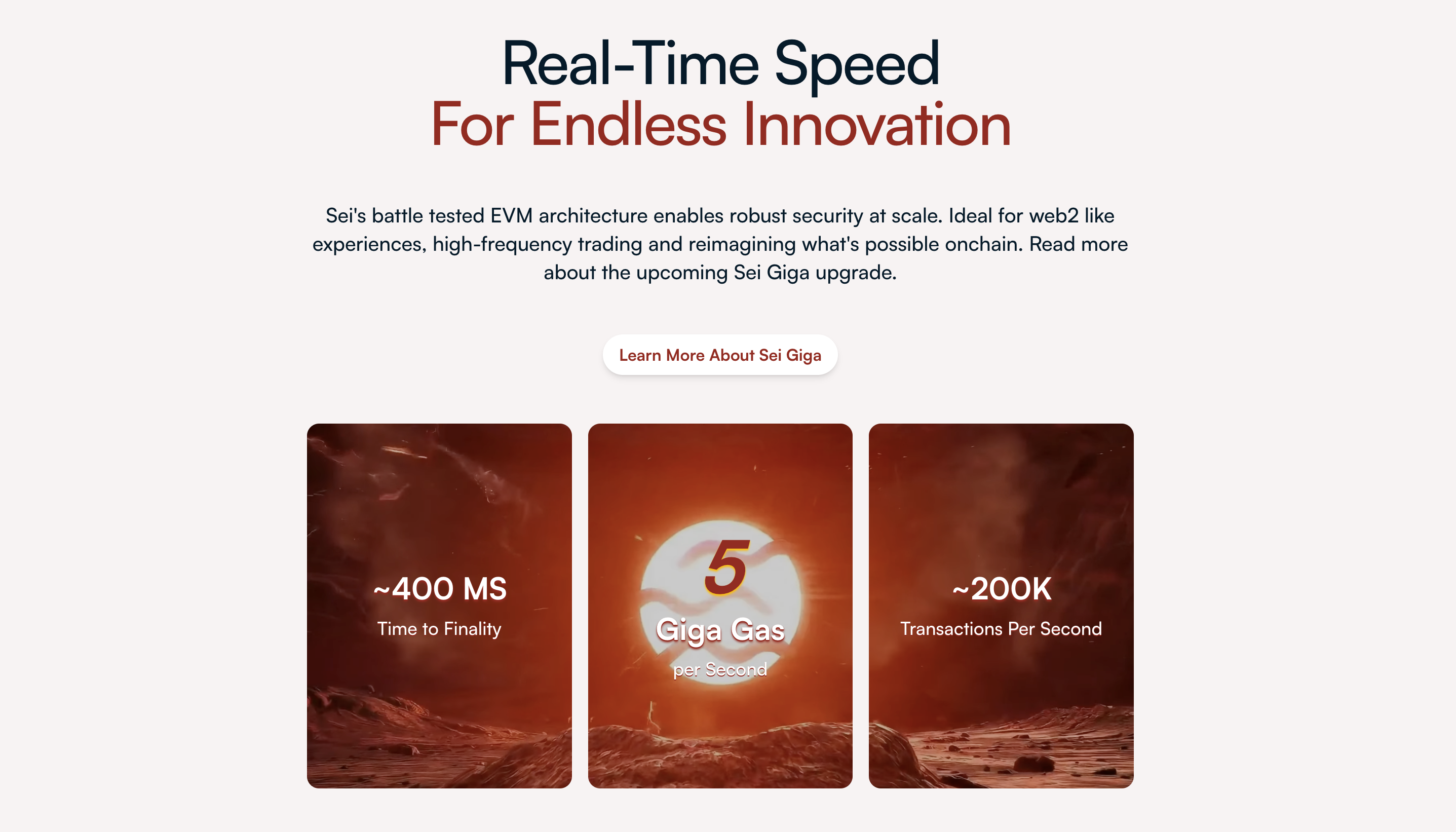

Sei was built with one main focus: trading. Its entire design is fine-tuned to make buying and selling assets as fast and smooth as possible. As a high-performance Layer-1 blockchain, Sei is tailored for high-frequency trading (HFT) and decentralized finance (DeFi) applications. With quick transaction finality and ultra-fast confirmations (around 400 ms), it’s a great choice for decentralized exchanges (DEXs) and any platform where speed is key [1] [13].

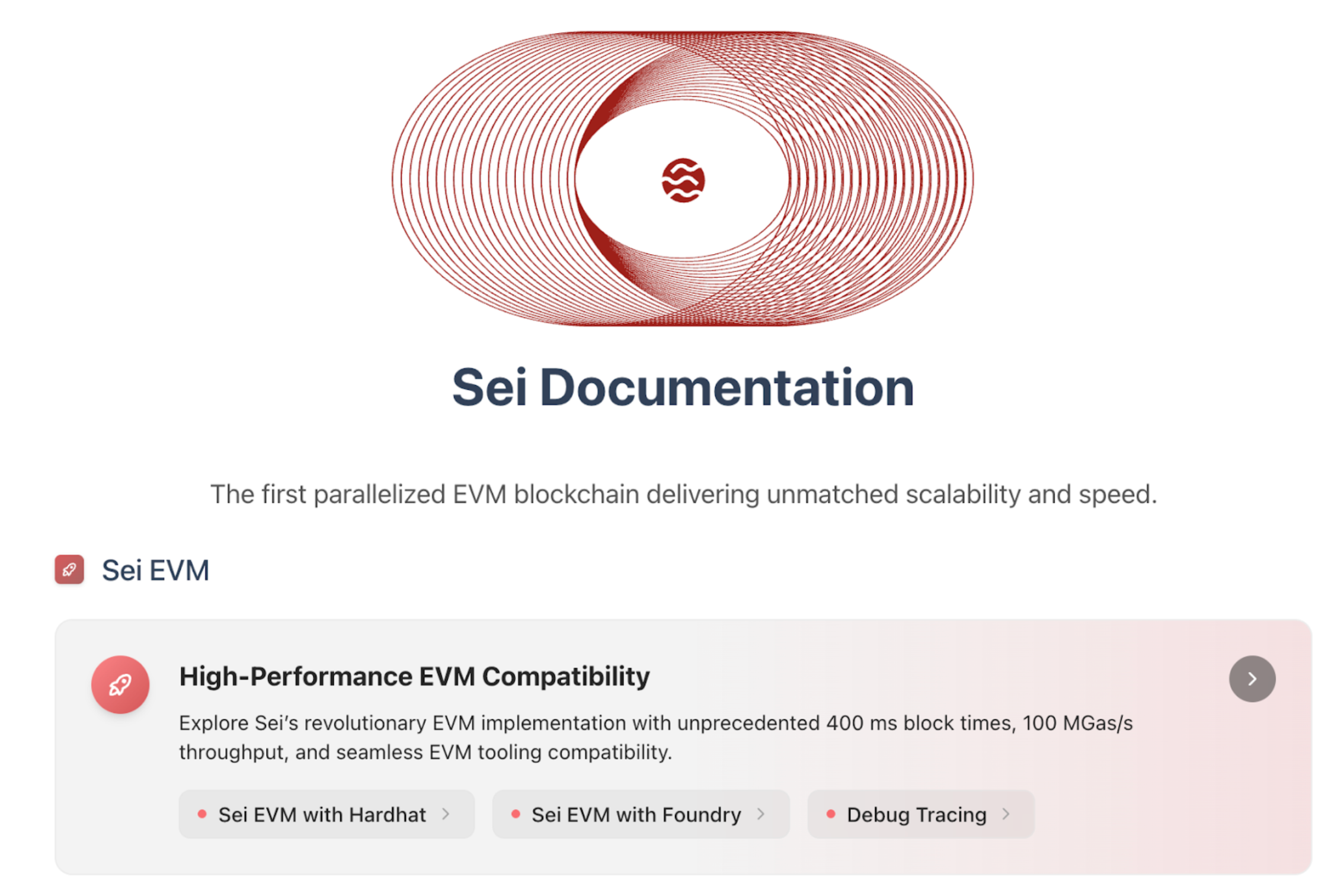

What really makes Sei stand out in the trading and DeFi space is how it combines super-fast transactions with strong reliability. Plus, its support for both EVM and CosmWasm gives developers a familiar platform to work with while tapping into some serious scalability [7].

While Solana is built for massive scale and consumer applications, Sei is all about speed and precision, designed with traders in mind who need those near-instant confirmations. Think of Sei like a high-end tool for trading, where every millisecond matters in a fast-paced market.

Core Features:

Finality: While Sei is theoretically capable of supporting 200,000 TPS in test environments, its real-world performance is lower. However, it is still optimized for low-latency finality and fast execution, making it ideal for high-frequency trading and DeFi applications [1].

Languages: Supports EVM and CosmWasm, allowing Ethereum and Cosmos SDK developers to build seamlessly [1].

Wallets: Compatible with MetaMask, Kepler, and other Cosmos wallets, allowing asset management across Ethereum and Cosmos without migration [1].

Potential Challenges: Potential Challenges: Being a newer network, Sei struggles with lower liquidity when compared to more established blockchains. Its success in scaling efficiently and competing in the growing DeFi and trading spaces will be crucial for its long-term viability [17].

What Is Solana?

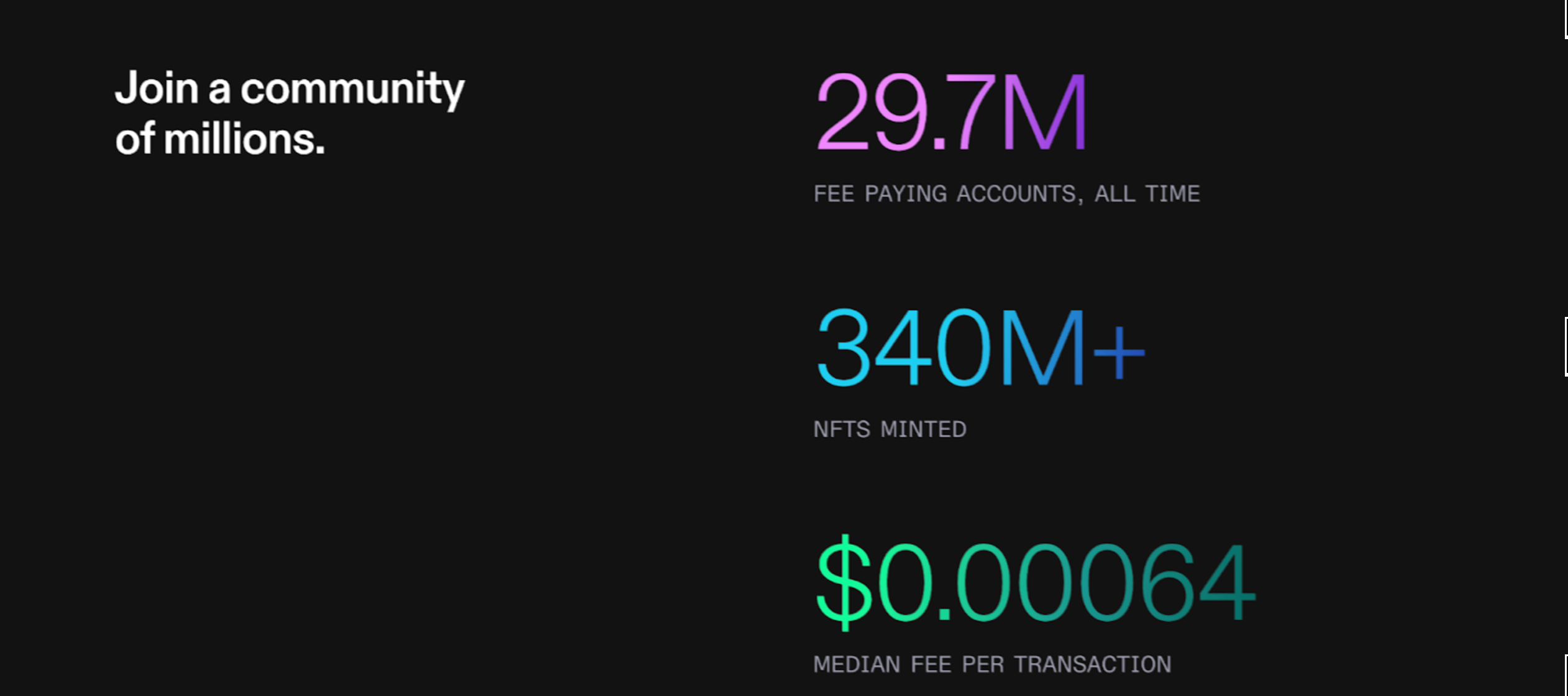

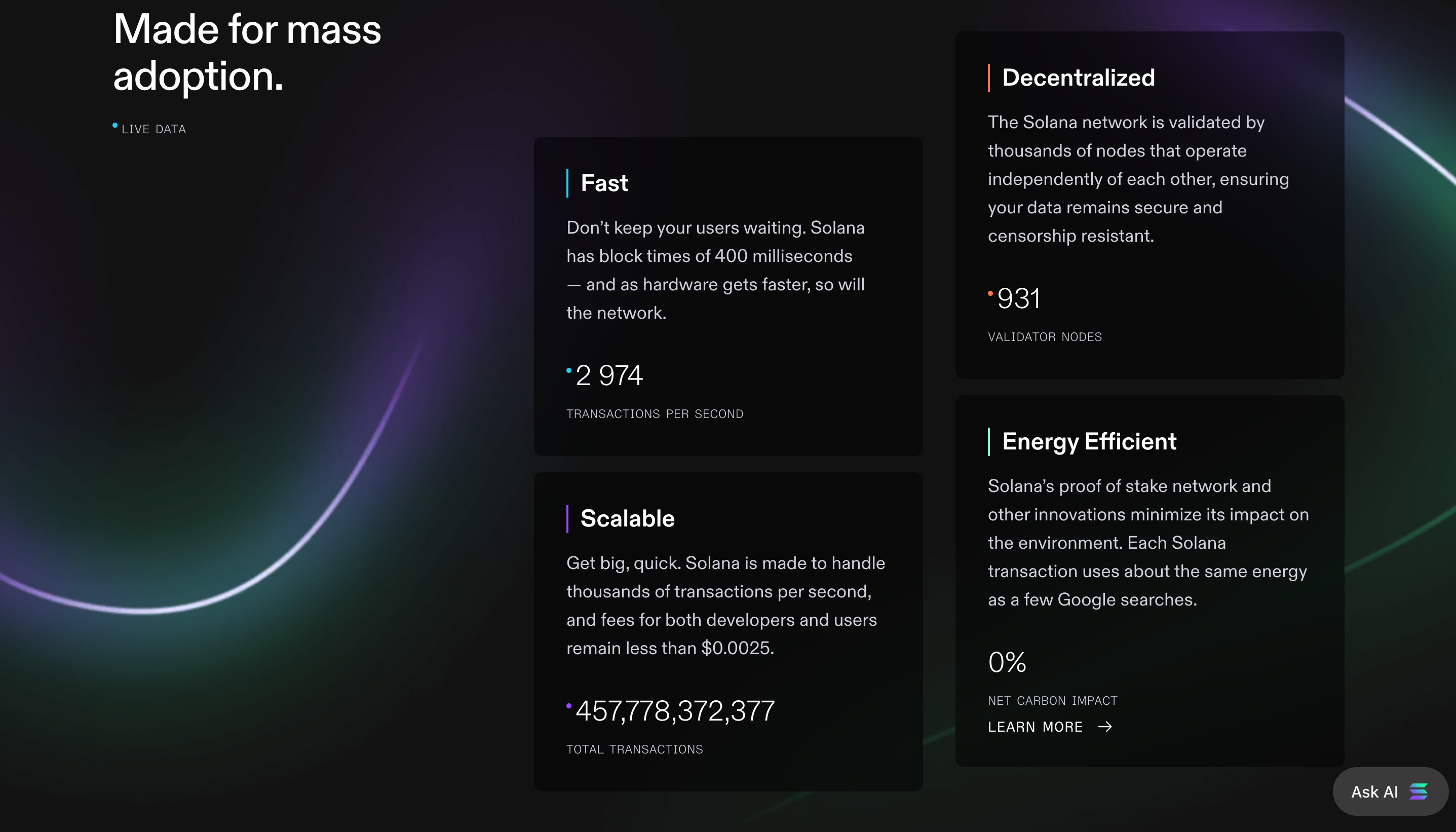

Solana is designed as a general-purpose blockchain that can handle a huge number of users and transactions at a very low cost. It's a proven platform for consumer applications like play-to-earn games, NFT marketplaces, and social apps. It boasts one of the largest and most active ecosystems in crypto, offering a wide variety of applications and a massive user base [2].

At its core, Solana rethinks blockchain architecture with its Proof of History (PoH) mechanism – a kind of cryptographic clock that enables its remarkable throughput. This design is where processing thousands of transactions per second is the norm [8].

For developers, Solana provides a well-established platform built on Rust and the Anchor framework, offering all the tools needed to create applications that can scale effectively. If Sei is like a precision tool designed for trading, Solana is more of a powerhouse, built to handle large, consumer-facing apps with low transaction costs [12][13].

Core features of Solana

Finality: Finality is based on the sub-second confirmations, perfect for high-volume applications like DeFi and gaming [2].

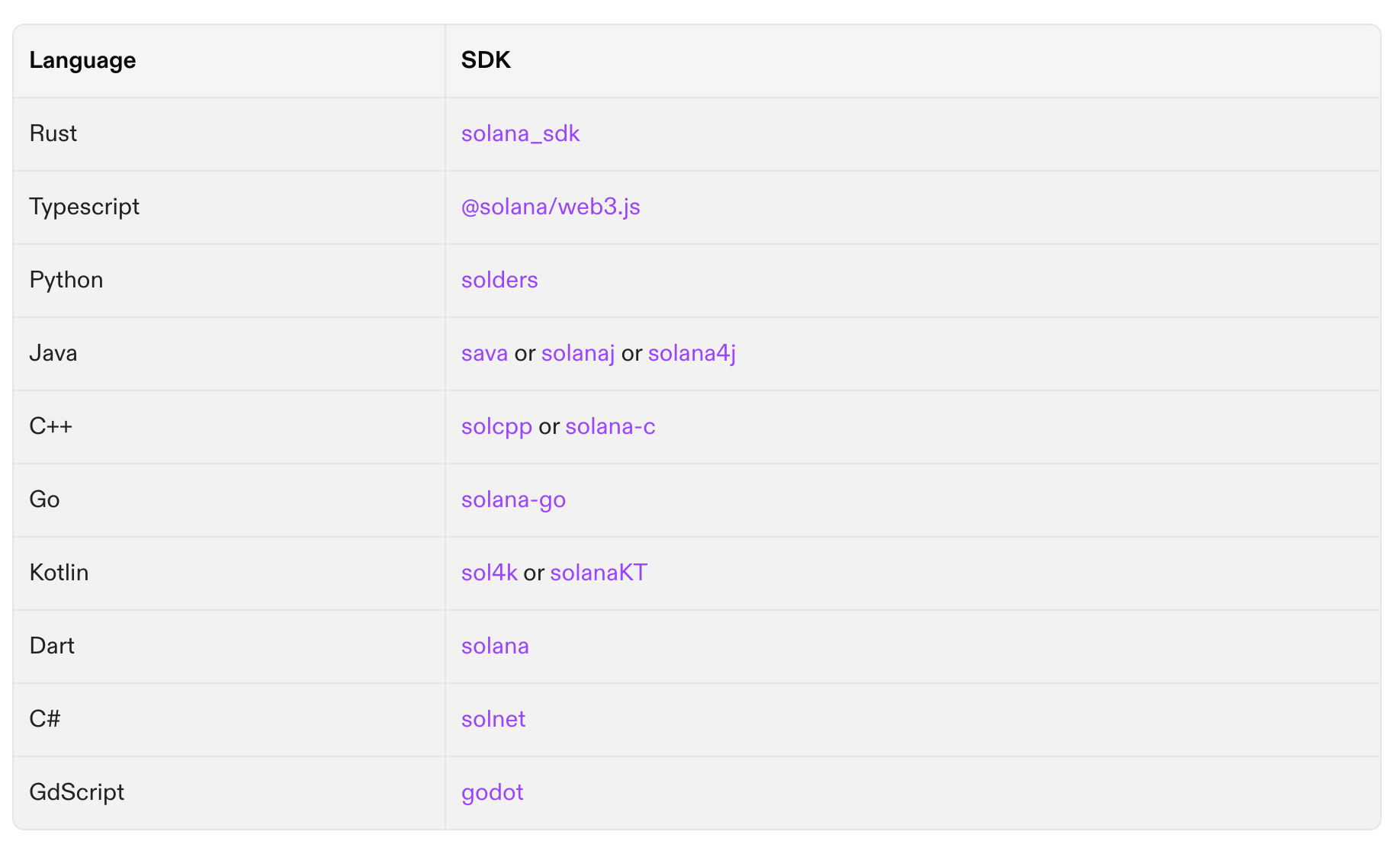

Languages: Primarily developed using Rust, but also supports C/C++ and Python, offering flexibility for developers [4].

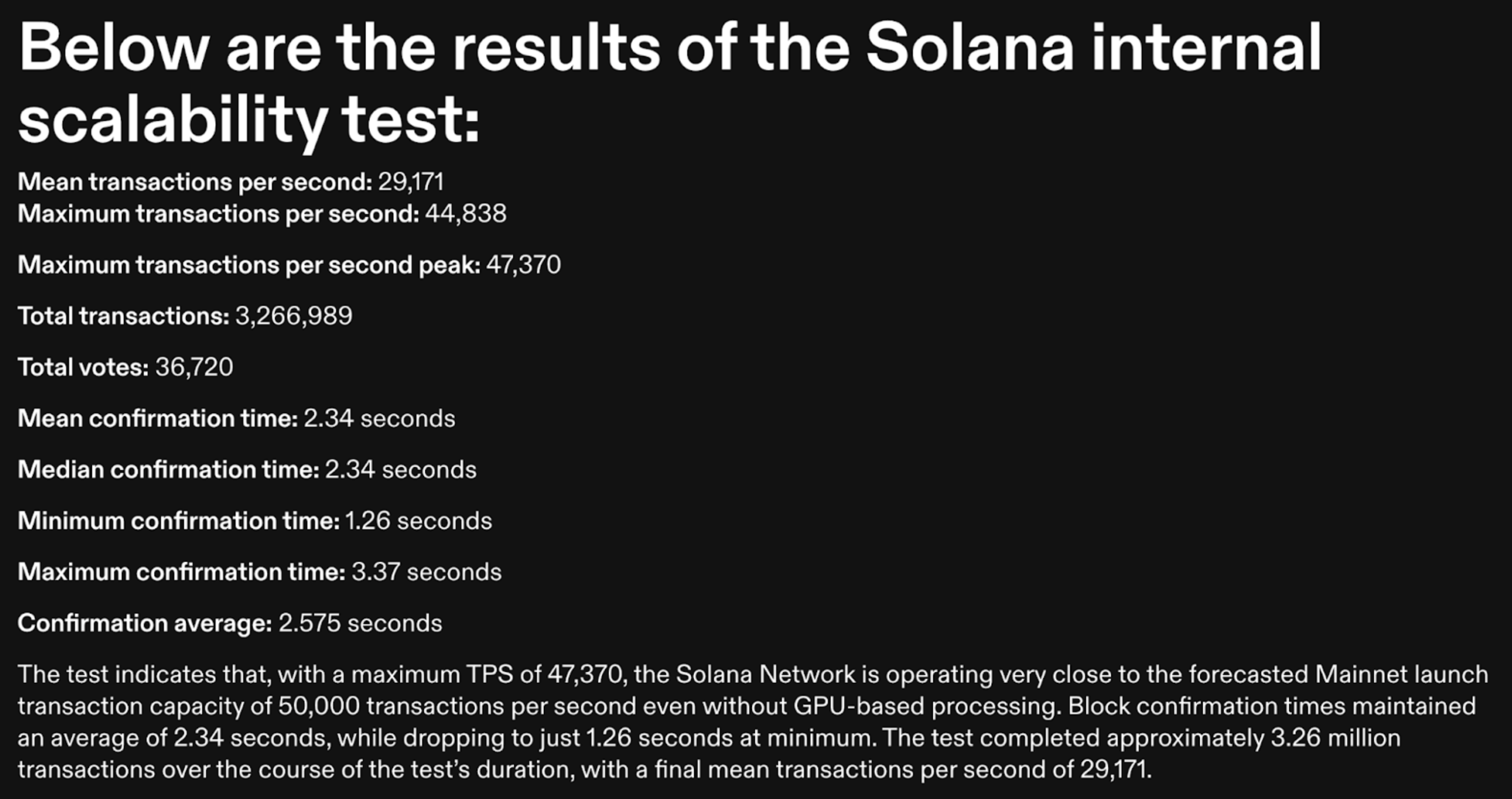

Scalability: Scalability is over 65,000+ TPS [2], making it one of the most scalable blockchains [2].

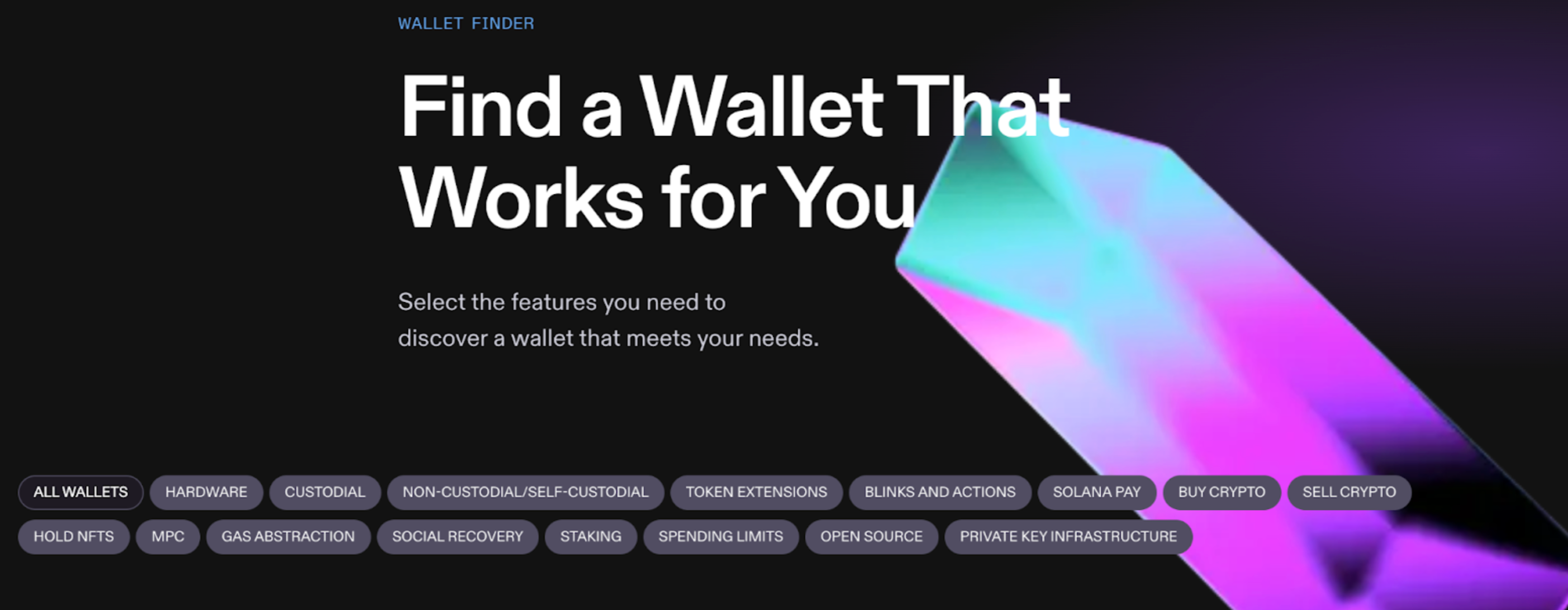

Wallets: Solana supports Phantom, Sollet, and WalletConnect for a user-friendly experience [2].

The Honeycomb Protocol [6], built on Solana, is changing the game for developers by simplifying the integration of Web3 features into their games. Honeycomb provides a suite of tools that simplify the Web3 game development process. With solutions like Edge Toolkit and Character Manager, game developers can easily integrate Solana's blockchain technology. This allows for a more streamlined development process and greater focus on game mechanics.

Introducing Solana Bench: A Benchmarking Tool for Developers

The Solana Foundation has launched Solana Bench, an open-source tool designed to validate performance on Solana's tools, focusing on tasks such as transaction processing and throughput validation, rather than error recovery [3].

Key Features of Solana Bench:

Basic: Tests maximize successful instructions using core SDKs (like @solana/web3.js).

Swap: Focuses on DeFi applications like Jupiter, Raydium, and others to evaluate developer efficiency. More details available on the Solana Bench page.

Potential risks: Solana has certain risks, despite being commended for its scalability and cheap transaction fees. The degree of centralization is one of the main issues because a small number of powerful validators control a sizable part of the network. From a tech standpoint, the validator concentration is a known issue that weakens both decentralization and security. And the network stability has a history. We all saw it go down multiple times in 2021. The code's been improved, for sure, but the core challenge of staying online under massive load remains its biggest hurdle.

How Do They Compare?

Wallets & Onboarding

If you’re used to Ethereum wallets like MetaMask, you’ll find Sei easy to navigate. On the other hand, Solana, with wallets like Phantom, provides a sleek and user-friendly experience that many find ideal for beginners.

Both Sei and Solana aim to make user onboarding as smooth as possible but follow different philosophies. Sei leans toward familiarity – thanks to its EVM compatibility, users coming from Ethereum will instantly recognize the flow of wallet connection and asset management.

In contrast, Solana prioritizes simplicity and ease of use. Its native wallets are built with newcomers in mind, featuring clean interfaces and one-click dApp connections, making it especially welcoming for beginners.

Integration with dApps

A wider range of applications can be found on Solana, from complex games to NFT marketplaces, which operate without disruption even with thousands of active users. While both Sei and Solana deliver smooth interactions with decentralized applications, each caters to a distinct audience.

On Sei, dApps are fast and responsive – the blockchain was specifically built for real-time trading. Even complex tasks like order matching are handled quickly, thanks to EVM compatibility and CosmWasm support, allowing Ethereum and Cosmos dApps to operate side by side without the need for migration.

Solana, on the other hand, excels in high-performance consumer applications – like games, NFTs, and DeFi platforms – that require heavy interaction from thousands of users at once. The Solana runtime and Anchor framework simplify state management, allowing developers to maintain speed and efficiency without sacrificing user experience [11].

Transaction Speed & Cost

When comparing "speed" in blockchains, it’s important to understand the difference between two key metrics: Throughput (TPS) and Time to Finality. Each measures something different, and which one matters more depends on your specific use case.

Throughput (TPS): The maximum number of transactions the network can process per second. This is a peak capacity indicator.

Time to Finality: The time it takes for a transaction to be considered irreversible. This is the key metric for users who need certainty (e.g., traders, merchants).

| METRIC | SEI | SOLANA |

|---|---|---|

| Theoretical Max TPS | Up to 200,000 (in controlled testnet environments) [1] | 65,000+ (theoretical limit) [2] |

| Observed Real-World TPS | Lower than theoretical; ecosystem-specific data is limited [9] | Consistently 2,000 - 5,000, with peaks observed beyond 10,000 [3] |

| Time to Finality | ~380-400 ms (achieving instant finality) [1] | ~0.4-1.2 seconds for optimistic confirmation, ~2.5-4.5 seconds for full probabilistic finality [4] |

| Transaction Cost | $0.001-$0.01 | <$0.0025 |

| Key Difference | Optimized for minimal latency and instant trade settlement | Optimized for massive throughput and parallel transaction processing |

WHAT IT MEANS:

- Theoretical TPS = Network potential, not daily reality

- Real-World TPS = Actual throughput under normal load

- Time to Finality = Key differentiator - Sei provides near-instant irreversibility

- Transaction Cost = Both offer negligible fees

Developer Support and Community

Sei Blockchain Community

Sei's GitHub and documentation support EVM and CosmWasm developers, while Solana offers extensive Rust/Anchor resources [1].

Solana Community

Solana boasts one of the largest developer ecosystems. With Rust as its main language, Solana provides a powerful framework for creating scalable dApps. The Solana Docs provide comprehensive developer guides to get started with building on the platform [2].

Let's compare Sei vs Solana and see the pros and cons of each ecosystem.

Pros and Cons of Each Ecosystem

| Feature | Sei | Solana |

|---|---|---|

| User-Friendliness | High (EVM compatibility, familiar tools for Ethereum users) | Moderate (some learning curve for Solana-specific, but excellent wallet UX) |

| Transaction Speed | ~400 ms finality – excellent for trading settlement [1] | 2,000-5,000 TPS real-world throughput – proven for mass adoption [2] |

| Transaction Fees | Ultra-low for trading applications ($0.001-$0.1) | Extremely low (often <$0.0025) |

| Developer Support | Growing community, EVM+CosmWasm support, and active GitHub | Large established community, extensive tools |

| Best Use Case | DEX, high-frequency trading | DeFi, NFTs, gaming apps, social Fi |

| Key Advantage | Instant trade finality | Massive transaction capacity |

The technical differences between Sei and Solana directly influence their security profiles and real-world adoption. Here's how they compare in practice.

Security and Reliability

Both networks are secure, though each faces its own set of challenges based on their design and stage of development. Solana has made notable strides in improving network stability since its outages in 2021-2022. However, its core challenge remains the balance between performance and decentralization, with concerns about validator concentration and high hardware requirements [15].

Sei's primary risks are those of a newer, specialized network. Its delegated Proof-of-Stake (dPos) model also faces questions about validator decentralization [6], and its long-term success is tied to its ability to attract a critical mass of liquidity and users in a competitive DeFi landscape [16].

Use Cases and Adoption: Sei vs Solana

To objectively assess the real-world traction of each blockchain, let's look at key ecosystem metrics. These numbers provide a snapshot of developer activity and user adoption.

| Ecosystem Metric | Sei | Solana |

|---|---|---|

| Total Value Locked (TVL) | ~$120 Million [17] | ~$10 Billion [14] |

| Key Strength | High-frequency DEXs, Perpetuals | Gaming, NFTs, Consumer DeFi, Social |

With Rust as the primary language, Solana offers a robust framework for building scalable dApps. The Solana Docs provide comprehensive developer guides to get started with building on the platform.

Data is approximate and fluctuates based on market conditions.

Both Sei and Solana have distinct strengths, each catering to different user needs.

Sei: The Trading Specialist

Sei's growth is concentrated in high-value trading. Its ~$120M TVL reflects a focused ecosystem where its 400ms finality shines. The $47M daily volume on DEXs like SeiSwap [8] proves its advantage for high-frequency trading. With 70+ teams building [9], Sei is cementing its role as the go-to chain for serious traders.

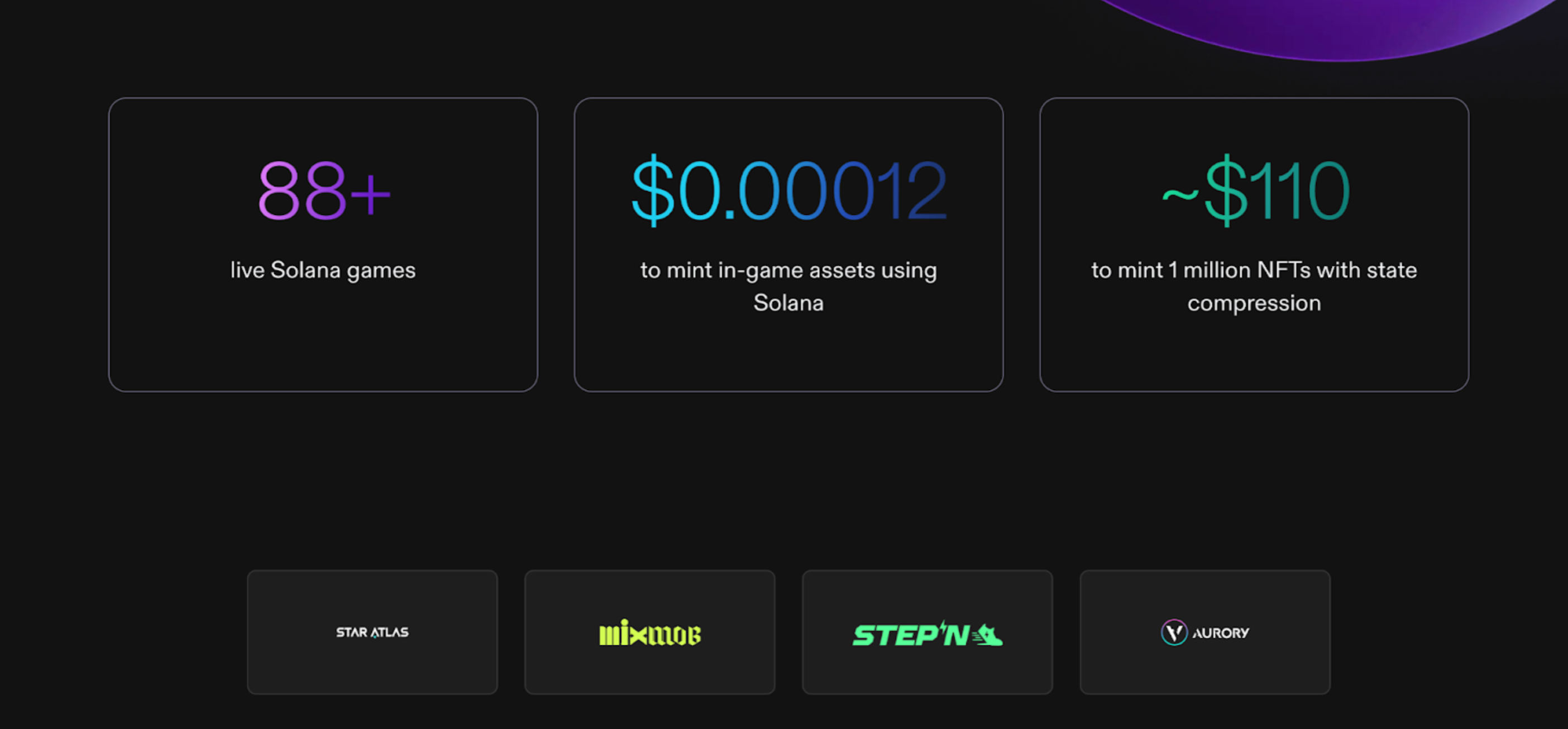

Solana: The Scale Powerhouse

Solana's ~$10B TVL [14] and 1000+ dApps create powerful network effects. It dominates multiple verticals: DeFi with giants like Raydium; NFTs with Magic Eden's $1B+ sales [10]; gaming with 100+ studios [11]. Solana remains the default choice for mass-market applications requiring deep liquidity and diverse interoperability.

Conclusion

In today's crowded market, both Sei and Solana have carved out strong positions.The real difference isn’t just raw performance, but the way each platform is built. The best choice for you depends entirely on the specific needs of your application, as each platform excels in different areas.

Sei and Solana each offer distinct advantages tailored to different blockchain use cases. Sei is optimized for traders and DeFi users, offering ultra-fast finality, and EVM/CosmWasm support – perfect for high-frequency trading. Solana shines for its scalability and flexibility, supporting large-scale dApps, gaming, and NFTs with sub-second finality, all backed by a strong developer ecosystem.

Choose Sei if your top priority is speed for trading. If you need a transaction to be 100% final in under a second–for example, when using a decentralized exchange–Sei's specialized design is the better tool for the job.

Choose Solana if you want a wide variety of apps and a large ecosystem. If you're interested in exploring everything from games and NFTs to social media on a proven, high-capacity network, Solana is the clear choice.

Both platforms are poised for growth, and exploring both networks may provide a comprehensive understanding of their unique strengths and potential applications in the evolving blockchain ecosystem.

Future Outlook and Development Trajectory

As we look to the future, both Sei and Solana appear to be doubling down on their respective specialties.

Sei's trajectory is likely to remain centered on optimizing for the trading vertical. Its success will depend on attracting more DeFi protocols and derivatives platforms to its ecosystem, leveraging its low-latency advantage [12].

Solana's path is geared towards achieving global scalability for consumer applications. With initiatives like Solana Bench [3] and Firedancer, the network aims to solve its historical stability issues while pushing the boundaries of throughput. Its ability to onboard the next wave of users in gaming and social Fi will be critical. Solana's existing user base and diverse dApp ecosystem create powerful network effects that lower barriers to adoption for new applications [13].

The blockchain landscape evolves rapidly, and success will favor platforms that demonstrate real-world utility, technological robustness, and sustainable growth–not just theoretical potential.

Sources

- Sei Documentation

- Solana Documentation

- Solana Bench

- Sei Whitepaper

- Helium Technical Guide

- Honeycomb Protocol Documentation

- Understanding Sei: A Comprehensive Overview

- Solana Whitepaper

- SEI DEX Trading Volume Surges to $47 Million in 24 Hours

- Kanga Exchange. (2025). SEI Network: everything you need to know about the Tier 1 solution for DeFi.

- Solana's DeFi TVL hits $10B, highest level in six-month high

- Decentralized games on Solana

- Sei protocol

- Solana Foundation Technical Roadmap

- Top Solana Decentralized Exchanges (DEXs) for 2025

- State of Solana, Messari

- Sei, DeFiLlama