Bitcoin Price Rollercoaster: Welcome to the 'Uptober'

Bitcoin has been on quite the rollercoaster lately, recently slipping back down to around $61,000 after a brief flirtation with the $66,000 range. This drop has left many in the crypto community scratching their heads, especially since it seemed like BTC was setting the stage for a solid rally. While there was plenty of buzz about Bitcoin reaching a new technical higher high, that excitement has quickly shifted as prices have cooled off.

What's Happening in the Market?

As Bitcoin dipped back toward $61,000 at the beginning of October, the similarities to past cycles are clear, sparking conversations about what these patterns could mean for Bitcoin's future. Geopolitical instability continues to influence price movements, alongside other factors. For instance, the recent announcement from HBO about a new film revealing the identity of Satoshi Nakamoto has generated increased interest in Bitcoin, further impacting its market dynamics.

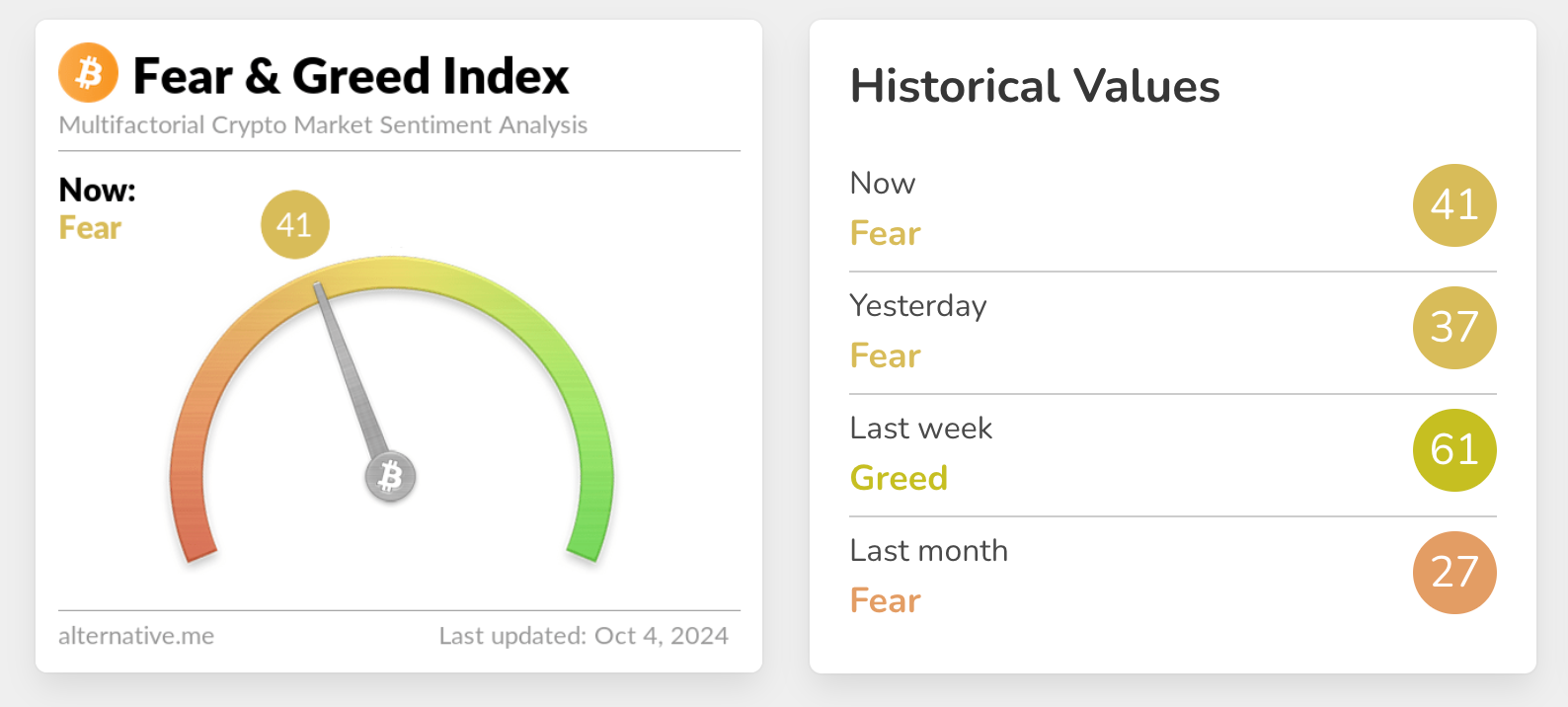

What's the market's reaction? Let's look at it through the lens of the well-known Fear and Greed Index. As of now, the Bitcoin market is wrapped in a wave of fear, a sentiment that has persisted throughout the past month. Investors remain cautious due to a mix of factors, including ongoing geopolitical tensions, potential regulatory changes, and broader economic uncertainties. This prevailing anxiety has led to increased volatility, keeping Bitcoin’s price hovering around the $60,000 mark.

F&G Index (4th of October). Picture Source: Alternative

The sustained period of fear reflects a hesitant approach from traders, who are waiting for clearer signals before making significant moves. Despite the current downturn, some analysts believe that this cautious phase could set the stage for future stability and growth once market confidence begins to rebuild.

With Bitcoin trading around $61,000, there’s a sense of cautious optimism in the air. This recent price action might indicate we’re approaching a critical point where a shift in the market could occur.

We’re now 160+ days past the latest Bitcoin halving, a pivotal event that often precedes significant price movements. Historically, Bitcoin tends to see surges 6-12 months after these halvings, so eyes are peeled for what might come next.

BTC price movements after Halving in 2020. Source: CoinMarketCap

According to a report from CoinMarketCap, Bitcoin is about 100 days ahead of its usual four-year cycle, raising hopes that we could see an all-time high sooner than anticipated—possibly between mid-May and mid-June 2025.

While the current dip may feel discouraging, the historical trends and underlying support for Bitcoin suggest that it still has the potential for a turnaround. As we move through Uptober, a month often associated with Bitcoin rallies, the upcoming weeks could prove to be pivotal for both newcomers and seasoned enthusiasts in the crypto space.

Whatever your feelings about BTC are, acting quickly is crucial — exchange, buy or sell BTC with the best fees instantly on ChangeNOW!