Bitcoin Halving 2024 Explained: What It Means for BTC and Altcoins

What is Bitcoin Halving?

A Bitcoin halving is a long-awaited event in the crypto world, when the reward for mining new blocks is halved. This allows to expand the total time needed to mine all 21 million bitcoins. And this feature is crucial as it helps to fight inflation and mimic the natural scarcity properties of physical commodities such as gold.

"The main reason why this is done is to keep inflation under control," — Vitalik Buterin, Ethereum creator.

The halving is not just a technical event; it's an important moment that has historically influenced Bitcoin's price and various aspects of the cryptocurrency ecosystem.

A little bit of history:

- The reward for mining started out at 50 BTC per block in 2009, when Bitcoin was presented to the public.

- In 2012, the first halving occurred, reducing the subsidy from 50 to 25 bitcoins.

- The next halving in 2016 halved the reward to 12.5 BTC.

- And the last halving in 2020 reduced the reward to 6.25 bitcoins.

As we see, halvings happen every four years, and the next one is expected to happen in April 2024. The exact date of the next Bitcoin halving depends on the mining activity and can slightly vary.

Why Study Halving History?

By examining the aftermath of the previous halvings, investors and enthusiasts can gain valuable insights into possible trends and market behaviors. The last Bitcoin halving event in 2020 caused a substantial bull market that saw Bitcoin reach unprecedented highs, underlining the significant impact halving events can have on market sentiment and valuation.

Let's look closer at the numbers.

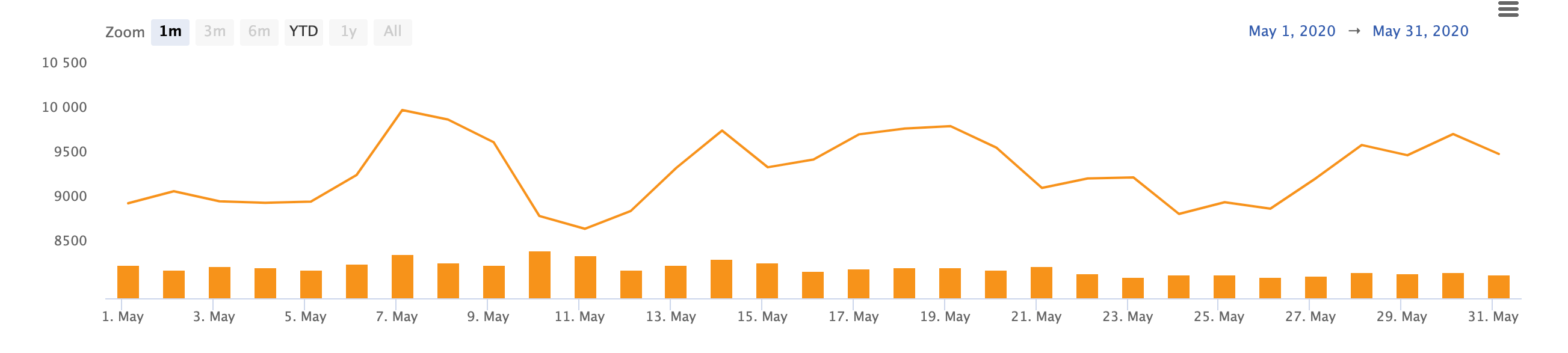

The average closing price for Bitcoin in May 2020 was $9,269. The minimum price was 8.616$ and the maximum price was 9.952$.

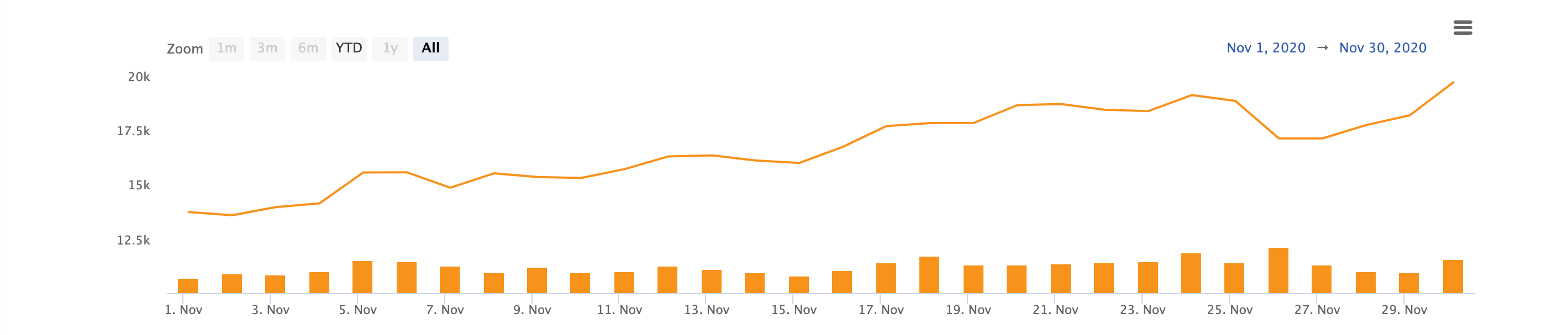

Six months after Halving, in November, the price almost doubled: the average closing price for Bitcoin was $16,665. The minimum price was $13.588 and the maximum price was $19.694.

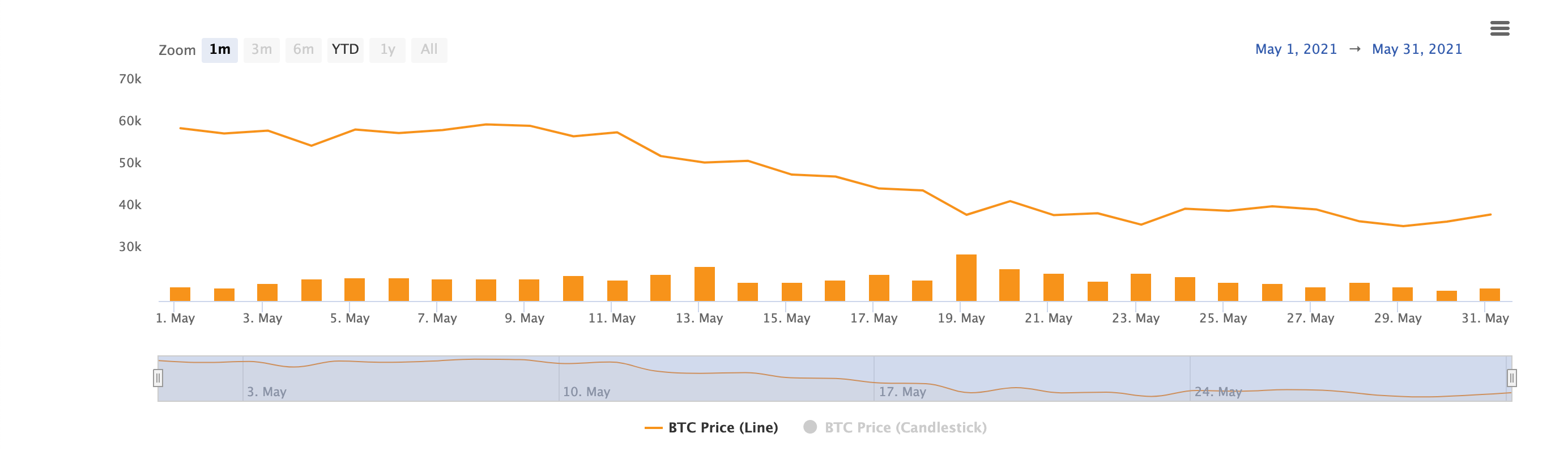

A year later, in May 2021, the average closing price for Bitcoin (BTC) was $46,620. The minimum price was $34.956 and the maximum price was $57.927.

Yet it was not the only reason for the bull run, the Bitcoin halving played a role in catalyzing a bull market. Historically, with each of the previous halvings, investors became more and more bullish, though it's important to remember that past performance is not always indicative of future results.

Remember! We DO NOT give any trading advice. It is highly recommended that you analyze all the risks yourself before acting.

How Will Halving Affect Altcoins?

Bitcoin halving events have significant implications not only for the world's first cryptocurrency but also for the whole cryptocurrency market. The effects of halving events ripple throughout the entire ecosystem, including altcoins.

During Bitcoin halving events, speculative activity in altcoins may become more intensive as investors seek opportunities for profits. However, increased volatility and uncertainty can also lead to greater downside risk for altcoins due to market corrections.

Altcoin projects with strong fundamentals, innovative technology, and active communities are more likely to withstand market fluctuations and emerge as leaders in their respective niches. Here are some of these:

- Ethereum (ETH)

- Solana (SOL)

- Ripple (XRP)

- Polygon (MATIC)

For instance, Ethereum, the second most popular crypto currency, is expected to strengthen after the Bitcoin halving.

"I would not be surprised to see ETH benefiting from the halving event even more than Bitcoin,” said Julian Grigo, head of institutions and fintech for Safe.

There are also optimistic predictions for Solana.

“Given that Bitcoin’s halving is just around the corner, it’s likely that BTC’s price will rally. That means a 35 to 45% gain in SOL versus BTC would bring it above the $300 milestone,” said Guy Turner, the host of YouTube channel Coin Bureau.

How to Keep Updated During the Bitcoin’s 4th Halving

Trading around the Bitcoin halving demands a nuanced understanding of cryptocurrency markets and the specific factors that drive Bitcoin's price.

- Using cryptocurrency tracking websites and platforms, like CoinTracking, helps to monitor real-time market data, including prices, trading volume, and market capitalization. These are important metrics that help you to see the overall picture and adjust your trading strategy.

- Being engaged with cryptocurrency communities on platforms like Reddit, LinkedIn, Twitter, and Discord allows a person to participate in discussions, ask questions, and share insights with fellow enthusiasts.

- Platforms like ChangeNOW facilitate the crypto exchange process by offering a user-friendly interface and instant exchange options, allowing traders to swiftly respond to market movements caused by the halving.