How Bitcoin Halving Will Affect Altcoins

The Bitcoin halving, a highly anticipated event in the cryptocurrency world, has far-reaching implications beyond just the king of cryptocurrencies itself. While much attention is given to how the halving affects Bitcoin's price, network security, and what to do before halving, the bitcoin halving effect on altcoins cannot be overlooked.

Before we start, make sure you know the basic terms.

- Altcoin - is any cryptocurrency besides Bitcoin (e.g. Ethereum (ETH), Solana (SOL), XRP (XRP), Dogecoin (DOGE)).

- Stablecoin - is a crypto asset pegged to another asset and designed to maintain a relatively stable price (e.g. Tether (USDT), USD Coin (USDC), Dai (DAI), Binance USD (BUSD), TrueUSD (TUSD)).

- Altcoin season (or Altseason) - is a period when altcoins experience a significant upsurge in value. Read more about Altseason in our article.

Market Sentiment and Volatility

During a Bitcoin halving, market sentiment tends to oscillate between heightened volatility and uncertainty, a phenomenon that inevitably impacts the altcoin market. Investors, wary of the unpredictable shifts in Bitcoin's value, often adopt a risk-averse strategy, leading to sell-offs in altcoins. This flight to perceived safety in Bitcoin creates a ripple effect, causing fluctuations in the prices of alternative cryptocurrencies.

However, post-halving, as the market stabilizes and confidence in Bitcoin renews, some investors may re-enter the altcoin market, seeking opportunities for higher returns. Thus, the interplay between market sentiment and volatility during and after a Bitcoin halving can significantly influence the trajectory of altcoins.

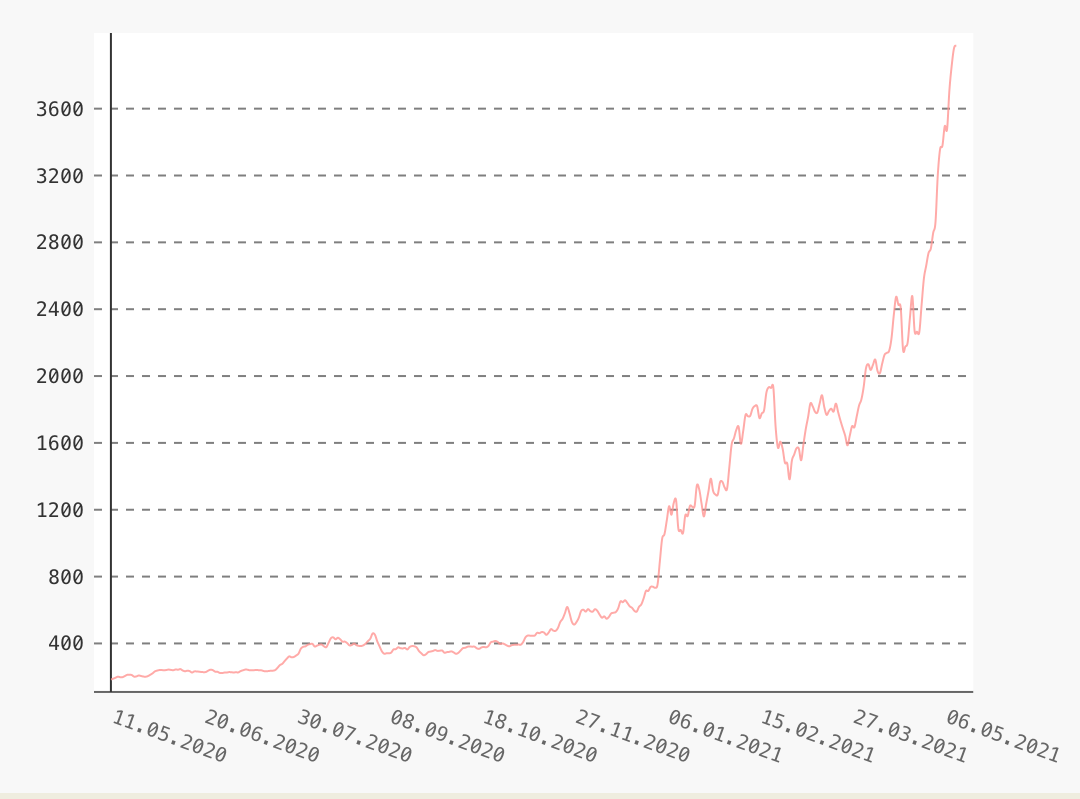

For instance, let’s look at the Ethereum (ETH) price changes between May 2020 and May 2021:

On the day of the Bitcoin halving on May 11, 2020, the price of ETH was $185.96, and a year later in May 2021 the price skyrocketed to $4,168 ( >2200%)

On the day of the Bitcoin halving on May 11, 2020, the price of ETH was $185.96, and a year later in May 2021 the price skyrocketed to $4,168 ( >2200%)

Of course, it was not only the halving that influenced the rapid growth of ETH. This is the result of many factors, but the influence of halving cannot be denied.

DISCLAIMER: We DO NOT give any advice. Always analyze everything yourself before trading and remember that past results are not an indicator of future success.

Bitcoin Dominance

Bitcoin dominance refers to the percentage of the total cryptocurrency market capitalization that is accounted for by Bitcoin alone. A Bitcoin halving has significant implications for Bitcoin dominance and its effect on altcoins.

In the run-up to Bitcoin halving there's bidding up of Bitcoin's rate and a consequent rise of discussions about Bitcoin among the crypto community. Whatever caused the temporarily decreased production may have sparked investors' interest and led to Bitcoin rise in price that can be explained by the scarcity effect. Read Bitcoin Price Prediction 2024

The reasoning behind this is straightforward: Bitcoin, as the first and most well-known cryptocurrency, tends to be seen as a safe haven and a store of value by investors. Therefore, when there's increased uncertainty or anticipation of significant events like a halving, investors may flock to Bitcoin, causing its dominance to rise.

After halving, the dynamics of Bitcoin dominance can play out in various ways. Historically, there's been a mixed impact on altcoins. In some cases, altcoins experience a period of decline as Bitcoin's dominance continues to rise, fueled by post-halving euphoria. This scenario is especially true for altcoins that lack strong fundamentals or unique value propositions, as investors may consolidate their positions into Bitcoin.

Some altcoins thrive in the aftermath of a Bitcoin halving. Some investors, having made significant gains from Bitcoin's price appreciation, may look to diversify their portfolios by allocating funds into promising altcoins. Innovations and developments within the broader cryptocurrency space can drive interest and investment into specific altcoins, leading to their outperformance relative to Bitcoin.

Ultimately, the effect of Bitcoin halving on altcoins depends on a myriad of factors, including market sentiment, investor behavior, and the fundamental strength of individual altcoin projects. While Bitcoin's dominance may experience fluctuations in the short term surrounding halving events, the long-term trajectory of both Bitcoin and altcoins is shaped by their utility, adoption, and ability to innovate within the rapidly evolving cryptocurrency ecosystem.

Attention and Investment Shifts.

One of the primary effects of Bitcoin halving on altcoins is the attention shift it generates. As discussions around Bitcoin's scarcity and potential price movements intensify, so does the curiosity about other digital assets. Investors, attracted by the optimism surrounding Bitcoin's growth prospects, may start exploring alternative avenues within the cryptocurrency space.

The Bitcoin halving serves as a reminder of the underlying principles of decentralization and innovation that justify the entire cryptocurrency ecosystem. This reminder can spark renewed enthusiasm for altcoins that offer unique features or address specific niche markets.

While Bitcoin's halving may draw attention to altcoins and stimulate investment, it doesn't guarantee uniform success across all alternative cryptocurrencies. Each altcoin operates within its own ecosystem, subject to its own dynamics and market forces.

Technological Innovation

Some altcoins may differentiate themselves by offering unique features or technological innovations that Bitcoin does not have. Investors who believe in the long-term potential of these altcoins may continue to hold and accumulate them despite Bitcoin's halving.

Altcoin projects may seize the opportunity presented by the next Bitcoin halving to differentiate themselves through technological advancements. They might emphasize features like scalability, privacy, smart contracts, or governance mechanisms that they believe surpass Bitcoin's capabilities. The halving event serves as a reminder for altcoin developers to innovate continuously to attract users and investors.

Conclusion

Bitcoin halving 2024 has the potential to significantly impact market sentiment regarding altcoins, contributing to increased volatility, uncertainty, and risk aversion among investors. While some altcoins may face headwinds as investors flock to Bitcoin during periods of uncertainty, others may find opportunities to differentiate themselves and attract investment based on their unique characteristics and value propositions. As with any major event in the cryptocurrency market, investors should carefully monitor market sentiment and fundamentals to make informed decisions about their altcoin investments.

DISCLAIMER: We do not give any financial advice. No one knows how high bitcoin will go, so always analyze everything yourself!