3 Reasons For The Current Market Turmoil

But the reality proved to be unpredictable – on June 14, Bitcoin plunged to $20,800, the minimum since December 2020. As of 15.00 UTC, the first cryptocurrency is trading at $22,200, it has lost 5% in price in the last 24 hours and 25% during the past week. The total crypto market cap plunged below $1 trillion.

There are thought to be three major reasons for the current crash:

- Amid growing inflation, the market expects the Federal Reserve to increase the interest rates, which could reinforce recession;

- Lower Fed rates may push investors to reduce the risk and abandon volatile assets including cryptocurrency;

- The fear index is still high following the Terra & UST collapse.

ChangeNOW reviews the market situation and speculates whether or not the turmoil is a natural market movement.

Inflation and the Fed Rates

Last Friday, U.S. authorities published the May inflation data: the price increase accelerated to a 40-year maximum of 8.6%. The stock market reacted with a crash – S&P 500 collapsed by 20% from its highest point in January.

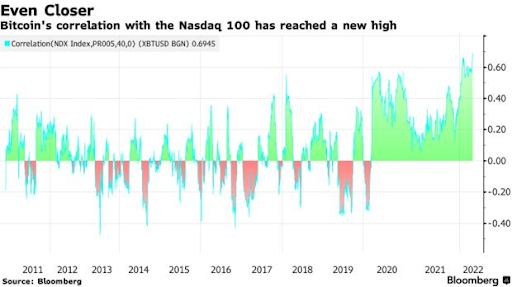

In the last few months, Bitcoin has been demonstrating a record-high correlation with stocks: in Q1 2022, the indicator surged to almost 70%. “Crypto was originally intended to be a separate decentralized environment, independent of traditional markets. Things have changed considerably since then,” explains Mike Ermolaev, ChangeNOW’s Head of PR, in a comment for Forbes.

“There has been a lot of money flowing into crypto from traditional markets these past couple of years,” says Mike. This explains why many investors treat crypto as just another type of asset today. And that’s why now, together with Big Tech and the stock market, cryptocurrency reacted to the news with a similar downfall.

Why does high inflation makes the markets plummet? Once the Friday data had been published, the investors changed their expectations: they now believe that the Federal Reserve is to increase the interest rates in response to inflation. This is likely to reduce credit availability, decrease the consumer activity, and cause recession as a result. Such negative anticipation shapes pessimistic sentiment among investors whose emotional state affects the market to a large extent. In a recent discussion with Invezz, Mike Ermolaev explained in more detail how Fed rates influence Bitcoin.

Risk Reduction…

The Federal Reserve has already increased interest rates in 2022, but that hasn’t stopped the inflation. The market is now worried that the Fed now will demonstrate even stronger dedication to the tightening of its policy.

As key rates increase, the tools such as the U.S. treasury bonds are likely to become more profitable. Investors expecting the unfolding of recession are giving up high-yield and high-risk assets like stocks and cryptocurrencies – and raise their stakes in low-risk bonds that are to bring more returns than before.

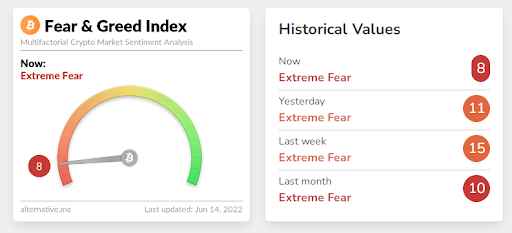

… Means Fear

The crypto market turmoil is aggravated by investors’ fears related to DeFi and the Luna/UST collapse consequences. The market players are expecting other major collapses in the industry and try to protect their savings by closing their positions. The Fear & Greed index has been in the extreme values during the last month.

Just A Market Cycle?

The Fed rate concerns, low-risk diversification, and fears cause a massive self-containing sellout of crypto assets. However, these may be just the “catalysts” for a natural decline: cycles are inherent to any market, and cryptocurrency is not an exception. After record growth in 2021, we’ve entered a bear phase – it had been predicted but unrolled faster and more dramatically than we expected.

ChangeNOW will keep an eye on the situation. The closest big date to watch over is June 15, when the Federal Reserve decides on the rate hike.