Ethereum Spot ETFs See $1B in Trading Volume

On May 23, 2024, the U.S. Securities and Exchange Commission (SEC) made a landmark decision by approving the first Ethereum (ETH) spot exchange-traded funds (ETFs). This approval represents a significant step forward for the cryptocurrency market, marking Ethereum's transition into mainstream financial products alongside its predecessor, Bitcoin ETFs, which were approved earlier this year.

The SEC's approval comes after extensive dialogue and multiple filings from major financial institutions, including Fidelity and BlackRock. These firms addressed various regulatory concerns, paving the way for the introduction of Ethereum ETFs on major exchanges like the New York Stock Exchange (NYSE) and Nasdaq.

Community and Industry Reactions

The crypto community has welcomed this move, viewing it as a major validation of Ethereum’s status as a leading blockchain platform. The approval is expected to enhance market liquidity and provide more structured investment opportunities for both retail and institutional investors.

Alex Kuptsikevich, a senior market analyst at FxPro, suggested in an email to CoinDesk that it wouldn't be surprising if Ethereum's price pulled back to the $3000 area, a significant consolidation zone, where large institutional investors might start building positions in the ETFs. Kuptsikevich noted a similar pattern observed in January after the approval of the Bitcoin ETF where Bitcoin's price dropped by 19% over the subsequent two weeks before experiencing a notable reversal.

23 of July - Spot Ethereum ETFs begin trading

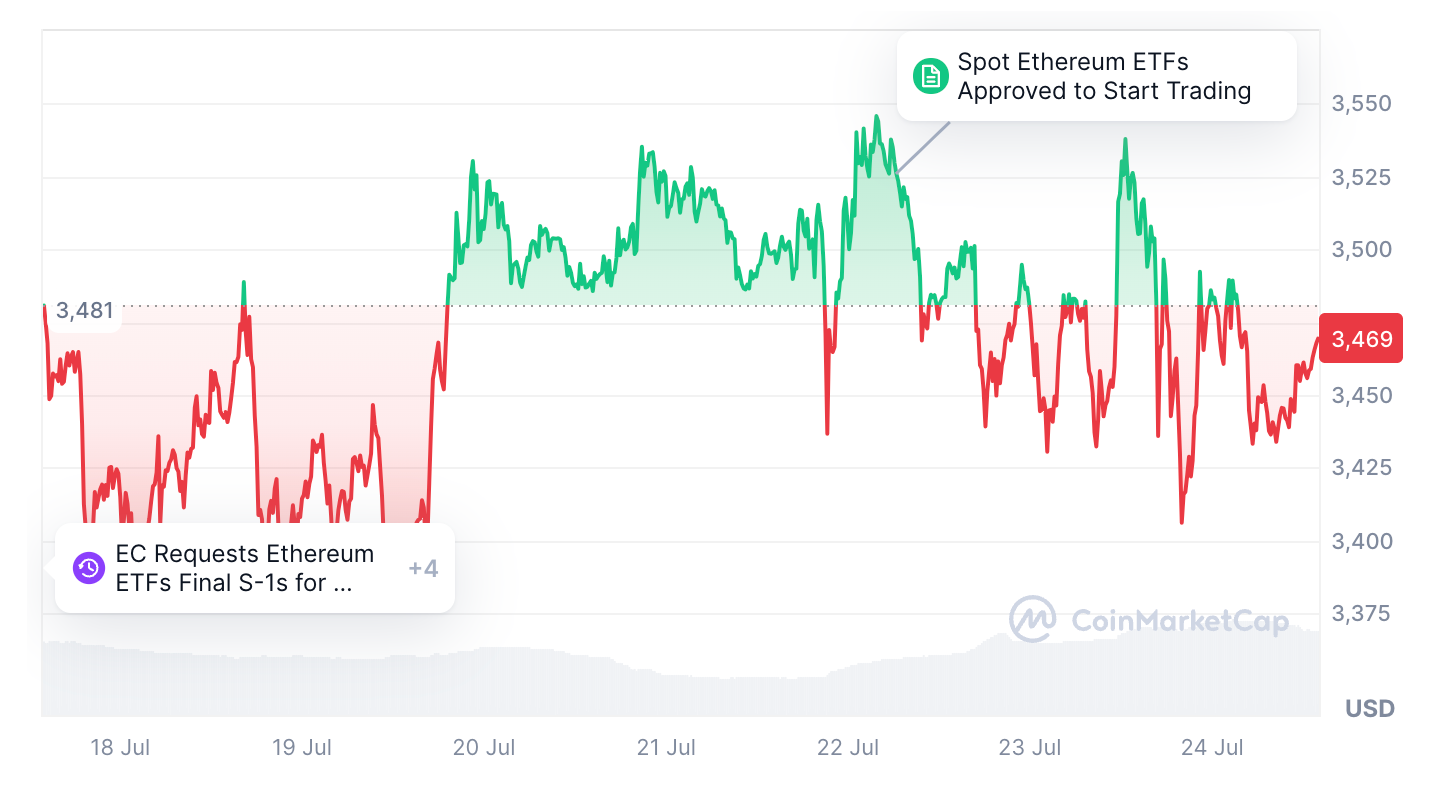

The Ethereum spot ETFs officially began trading on July 23, 2024, with listings on major exchanges such as the New York Stock Exchange (NYSE) and Nasdaq. On the first trading day, Ethereum's price stood at approximately $3,480, reflecting a decrease of 8.07% since the approval announcement on 23 of May.

Picture Source: CoinMarketCap

Analysts predict that while initial price fluctuations are expected, the long-term outlook remains optimistic, with potential for significant gains as institutional investments come in.

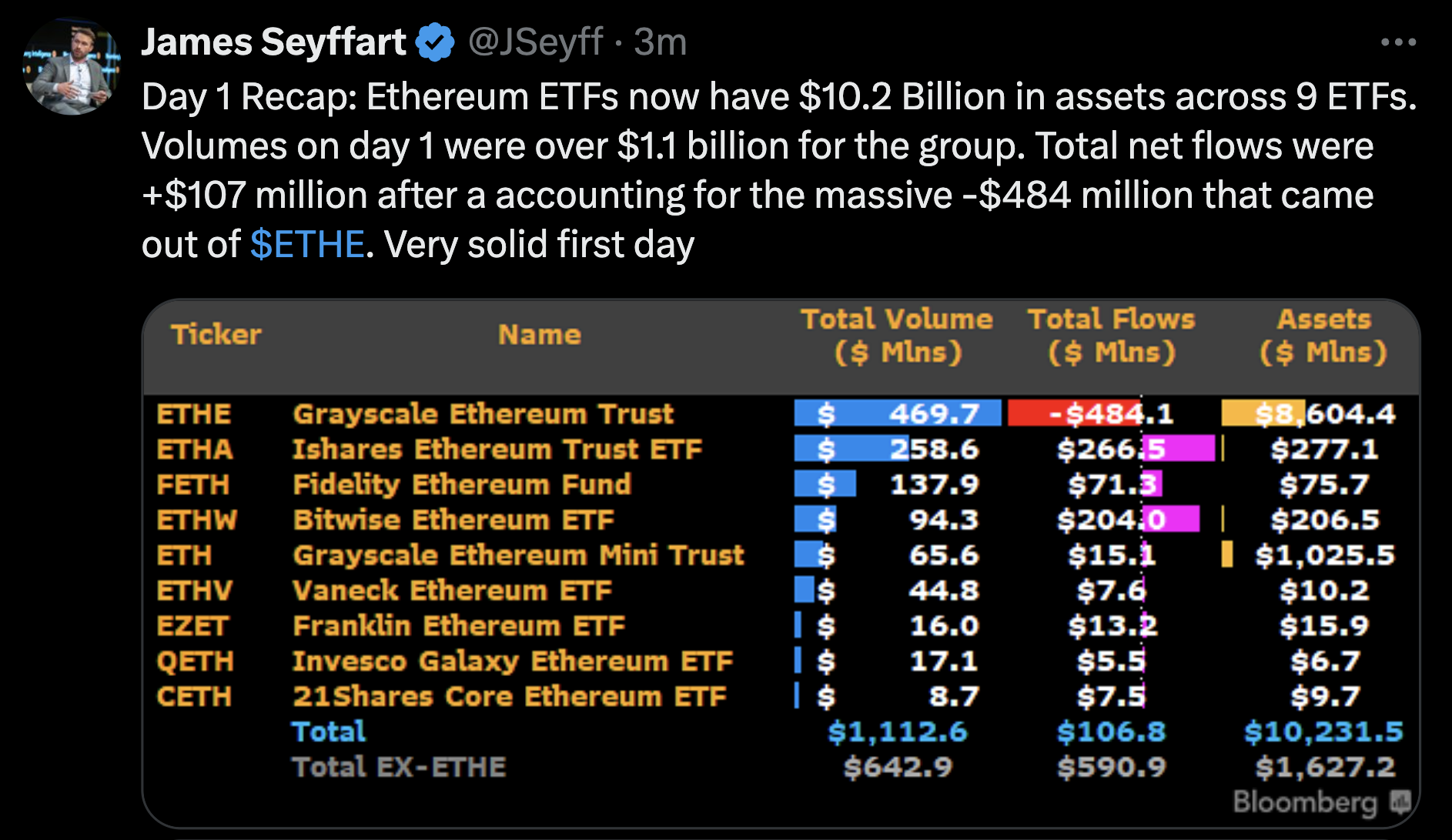

James Seyffart, an ETF analyst, provided a detailed recap on his X (formerly Twitter) account, highlighting the strong performance on the first day of trading. According to Seyffart, the Ethereum ETFs collectively amassed $10.2 billion in assets across nine different ETFs. Day 1 trading volumes exceeded $1.1 billion for the group, showcasing robust market interest.

The approval and launch of Ethereum spot ETFs mark a pivotal moment for the cryptocurrency market, highlighting Ethereum’s increasing integration into mainstream finance. With strong initial trading volumes and positive net flows, the Ethereum ETFs have made a promising start.