Ethereum Transactions Rise Thanks to DeFi Yield Farming?

Daily transactions on the Ethereum network have oscillated considerably over the last few years. February 2018 was the last time that Ethereum was posting numbers of over one million transactions every 24 hours. Despite its variability, Ethereum’s network has maintained an impressive level of activity consistently for the last few years, firmly entrenching the digital currency as Bitcoin’s trusty sidekick. However, in the past few months, Ethereum transactions have skyrocketed thanks to decentralized finance (DeFi) yield farming. So much so that the number of transactions performed daily on the network has rivaled that of its 2018 performance, boasting over 1.2 million Ethereum transactions per day. Ladies and gentlemen, we have again reached phase Ethereum 1 million!

What Is DeFi Yield Farming

DeFi yield farming is all the rage right now, but what exactly is it? Basically, it is just a way for those who own crypto assets to “loan” their crypto to startups in exchange for more cryptocurrency. Tokens like COMP and MakerDAO run on the Ethereum network and offer borrowers and lenders a modest amount of tokens to encourage crypto loans. Without getting too much into the nitty-gritty of how it works, yield farming is essentially a way for anybody to become a lender and make some easy cash, bypassing the red tape usually required to get into the lending game. DeFi yield farming has exploded. Many have made millions, some have lost their life savings, and more and more people are joining the craze every day.

DeFi Yield Farming, Ethereum, And The Blockchain Trilemma

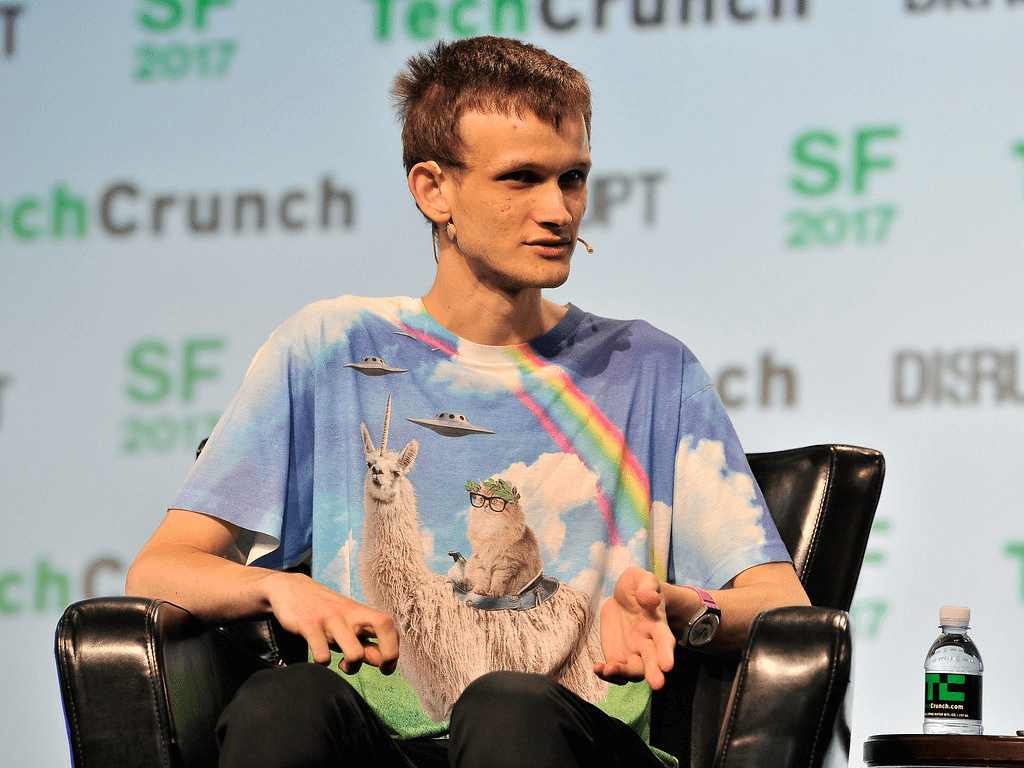

So what does DeFi crypto have to do with Ethereum? Many of the most prominent projects operating in the DeFi space, such as Compound and MakerDAO, use the Ethereum network to power their transactions. With the recent DeFi frenzy, Ethereum’s prominent role has really turned the enterprise into Ethereum farming. This has led to a massive increase in transaction volume over the network. This is extremely encouraging for Ethereum investors because it means that (1) the market for crypto is growing, and (2) Ethereum’s share of that market is growing with it.  However, some dangers lurk ahead in the near future for the Ethereum farm. To understand the problems, we need to back up a little. A few years ago, the founder of Ethereum, Vitalik Buterin, invented the term “Blockchain Trilemma.” Buterin contended that blockchain technology can only have two of the following three features: (1) Security, (2) Scalability, and (3) Decentralization. If the theory holds, if a blockchain network like Ethereum has robust security and true decentralization, then it cannot be scalable, i.e. it cannot handle the transactions that will follow any sort of mass adoption of blockchain technology. True to its founder’s formula, the Ethereum farm network now seems to be suffering from a lack of scalability. Getting back to DeFi’s effect on Ethereum, the nearly exponential growth of transaction volume occurring on the network due to the DeFi craze has highlighted some problems with Ethereum’s scalability. Most importantly, the network’s transaction fees have skyrocketed along with the network’s increased usage. Recently, Blockchair reported that on September 1st the average fee for a transaction on Ethereum’s network was a whopping $11.75. The median transaction was not far behind, costing traders $6.34. The rise in transaction fees makes a lot of sense in terms of basic supply and demand — as the demand for transaction verification grows, the price of verifying that transaction will increase.

However, some dangers lurk ahead in the near future for the Ethereum farm. To understand the problems, we need to back up a little. A few years ago, the founder of Ethereum, Vitalik Buterin, invented the term “Blockchain Trilemma.” Buterin contended that blockchain technology can only have two of the following three features: (1) Security, (2) Scalability, and (3) Decentralization. If the theory holds, if a blockchain network like Ethereum has robust security and true decentralization, then it cannot be scalable, i.e. it cannot handle the transactions that will follow any sort of mass adoption of blockchain technology. True to its founder’s formula, the Ethereum farm network now seems to be suffering from a lack of scalability. Getting back to DeFi’s effect on Ethereum, the nearly exponential growth of transaction volume occurring on the network due to the DeFi craze has highlighted some problems with Ethereum’s scalability. Most importantly, the network’s transaction fees have skyrocketed along with the network’s increased usage. Recently, Blockchair reported that on September 1st the average fee for a transaction on Ethereum’s network was a whopping $11.75. The median transaction was not far behind, costing traders $6.34. The rise in transaction fees makes a lot of sense in terms of basic supply and demand — as the demand for transaction verification grows, the price of verifying that transaction will increase.

Conclusion

Such high transaction fees are simply not scalable, particularly if they continue to increase as the network becomes more and more congested. Ethereum has been working on solutions to their scalability and transaction fee issues in the form of Ethereum 2.0, which launched phase 0 on August 25, 2020. However, the Ethereum team will need to beef up the next generation of its network, as the issue of exorbitant transaction fees still seems to be plaguing the Ethereum community as evidenced by the fees recorded on September 1st. As with all crypto fads, only time will tell if DeFi yield farming is a sustainable enterprise, but the strain it has put on Ethereum’s network should be a lesson to all crypto enthusiasts that there is still much to be worked out before blockchain technology can provide mass scalability. We have reached Ethereum 1 million, but we are far from the finish line.

About the author: Motiur is a freelance writer and digital marketing specialist based in Stockholm, Sweden. He started his career as an SEO expert back in 2011 and found his interest in the Crypto and Blockchain space later in 2016.