Bitcoin Halving 2024: Paving the Way for Crypto's Future

The Bitcoin world is buzzing with anticipation for a game-changer event expected in April 2024: Bitcoin's 2024 Halving. This isn't just any date on the calendar – it's a major shake-up that could send waves through your BTC wallet and the entire crypto scene.

We're diving deep into what this halving buzz is all about, how it's set to tweak Bitcoin's heartbeat, and what it could mean for everyone looking to get BTC. Whether you're in it for the long haul or just getting your feet wet, this guide is your go-to for catching the wave and making the most out of Bitcoin's next big leap!

Understanding Bitcoin

Bitcoin, the trailblazer of cryptocurrencies, has intrigued everyone from crypto aficionados to those just dipping their toes into digital currency waters. Birthed by mysterious Satoshi in 2008, Bitcoin operates as a decentralized digital currency, championing the essence of limited supply and secure, intermediary-free transactions and Bitcoin payments, revolutionizing the financial landscape.

What is Bitcoin Halving?

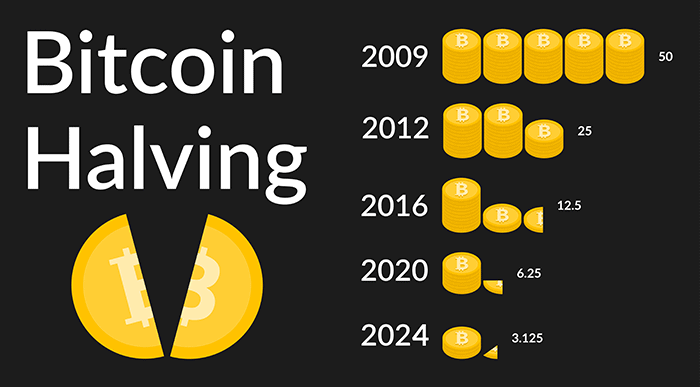

Bitcoin halving is a cornerstone event that transpires after every 210,000 blocks, roughly every four years, diminishing the mining reward by half. Crafted ingeniously by its enigmatic creator, Satoshi Nakamoto, this event is a strategic maneuver to curb inflation, curtail the pace of Bitcoin generation, and instill a sense of scarcity akin to finite natural resources. It fortifies Bitcoin's stature as an asset of immense value and rarity.

The Impact on Bitcoin's Supply and Market Dynamics

The halving significantly impacts Bitcoin's supply and market dynamics. By reducing the reward for miners, the event decreases the rate at which new Bitcoins are created, thus limiting the supply. This scarcity can lead to increased demand and potentially higher prices, influencing the entire cryptocurrency market. It's a reminder of Bitcoin's uniqueness in the field, where its predetermined scarcity plays a crucial role in its valuation.

A Retrospective on Bitcoin Halvings

Source: CoolWallet

Source: CoolWallet

The 2012 Milestone

The inaugural halving in 2012 saw the mining reward dwindle from 50 to 25 bitcoins, setting the stage for Bitcoin's deflationary narrative. This seminal event was closely followed by a marked appreciation in Bitcoin's market value.

The 2016 Episode

In its second iteration, the halving diminished the mining reward from 25 to 12.5 bitcoins. This episode captured widespread attention, fuelling market speculations and culminating in a progressive surge in Bitcoin's valuation over the ensuing months.

The 2020 Chapter

The third halving pared down the reward to 6.25 bitcoins. In the throes of a global health crisis, BTC demonstrated its mettle and allure as a 'digital gold', scaling new heights in valuation and solidifying its market position.

Envisioning a Post-Maximum Supply Bitcoin Landscape

Once the Bitcoin supply hits its ceiling of 21 million coins, the creation of new bitcoins will cease. Miners will then pivot to transaction fees as their sole remuneration. This anticipated transition is poised to reshape Bitcoin's economic paradigm, potentially fostering enhanced stability in transaction fees and network operations.

Anticipating the Outcomes of the Fourth Halving

The impending fourth halving in April 2024 is poised to reduce mining rewards to a mere 3.125 bitcoins per block. This significant constriction in block rewards is expected to tighten the supply of new bitcoins on the market, potentially driving demand and amplifying prices. Preceding halvings have traditionally been precursors to bullish market trends, and the 2024 event is likely to be the harbinger of another exhilarating epoch in Bitcoin's narrative.

What is the Long-Term Impact on Bitcoin?

The long-term impact of Bitcoin halvings is profound, reinforcing Bitcoin's deflationary nature and underscoring its value proposition as digital gold. As the reward for mining decreases, the scarcity of Bitcoin increases, which could lead to a higher valuation over time. Furthermore, as the supply of new bitcoins diminishes, the security and robustness of the network are anticipated to strengthen, potentially making Bitcoin an even more attractive asset for investors seeking a hedge against inflation and a store of value in the digital age.

How to Exchange Bitcoin on ChangeNOW

Getting Bitcoin on ChangeNOW is straightforward and user-friendly:

- Visit the ChangeNOW’s website

- Choose BTC from the list of currencies.

- Decide on the currency you want to exchange for Bitcoin.

- Enter the amount you wish to exchange and provide your wallet address.

- Finalize the transaction by confirming the details. ChangeNOW will process the exchange instantly.

Exchanging BTC via ChangeNOW enables you to capitalize on the forthcoming halving event.

Capitalizing on the Potential of Bitcoin Halving

The halving of Bitcoin transcends a mere technical recalibration; it's a pivotal economic juncture that historically heralds the dawn of invigorating phases for the currency and its stakeholders. Irrespective of your experience level in the crypto domain, grasping the nuances and potential ramifications of the 2024 halving is crucial for making informed decisions and capitalizing on the opportunities that this dynamic sector presents.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as financial or investment advice. Cryptocurrency investments are subject to market risks, and individuals should conduct their own research and consult with professionals before making any investment decisions. ChangeNOW is not responsible for any financial losses incurred as a result of using its services.