Instant crypto loan

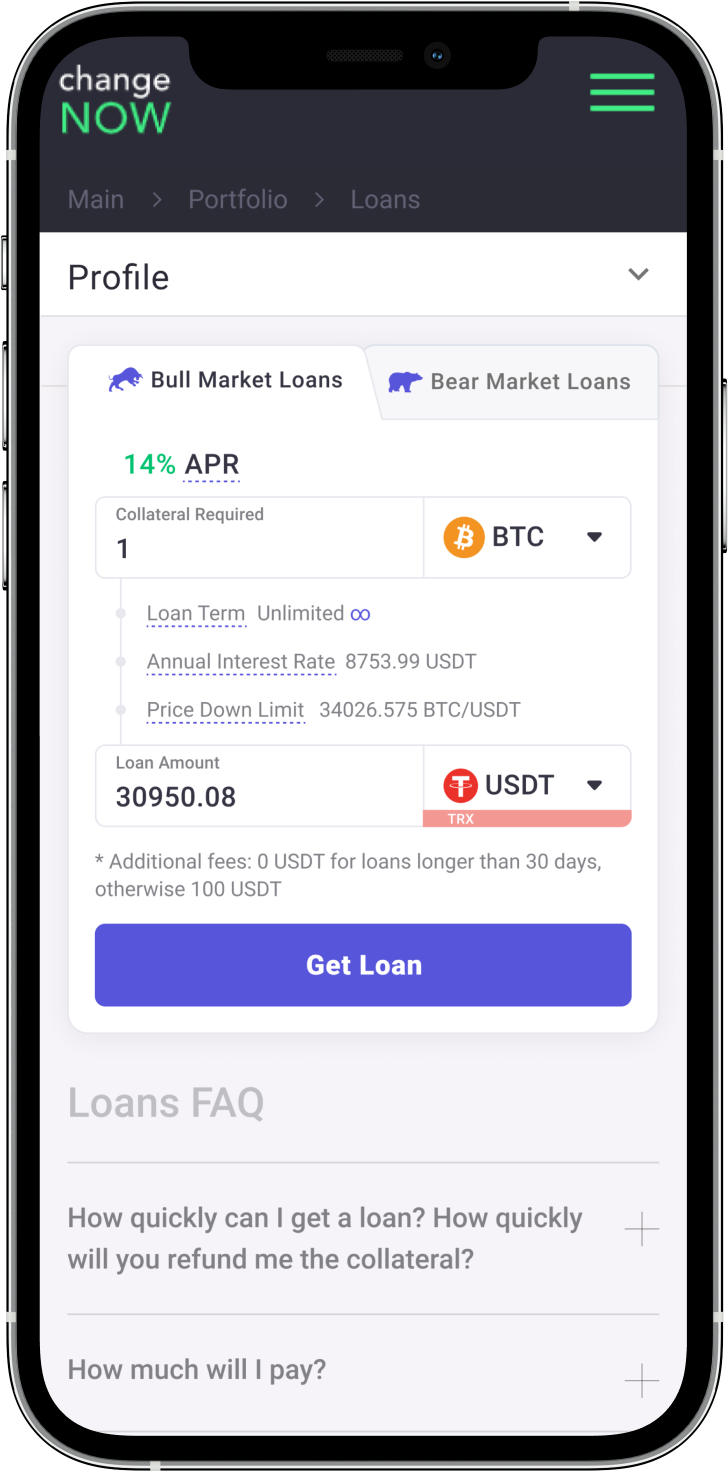

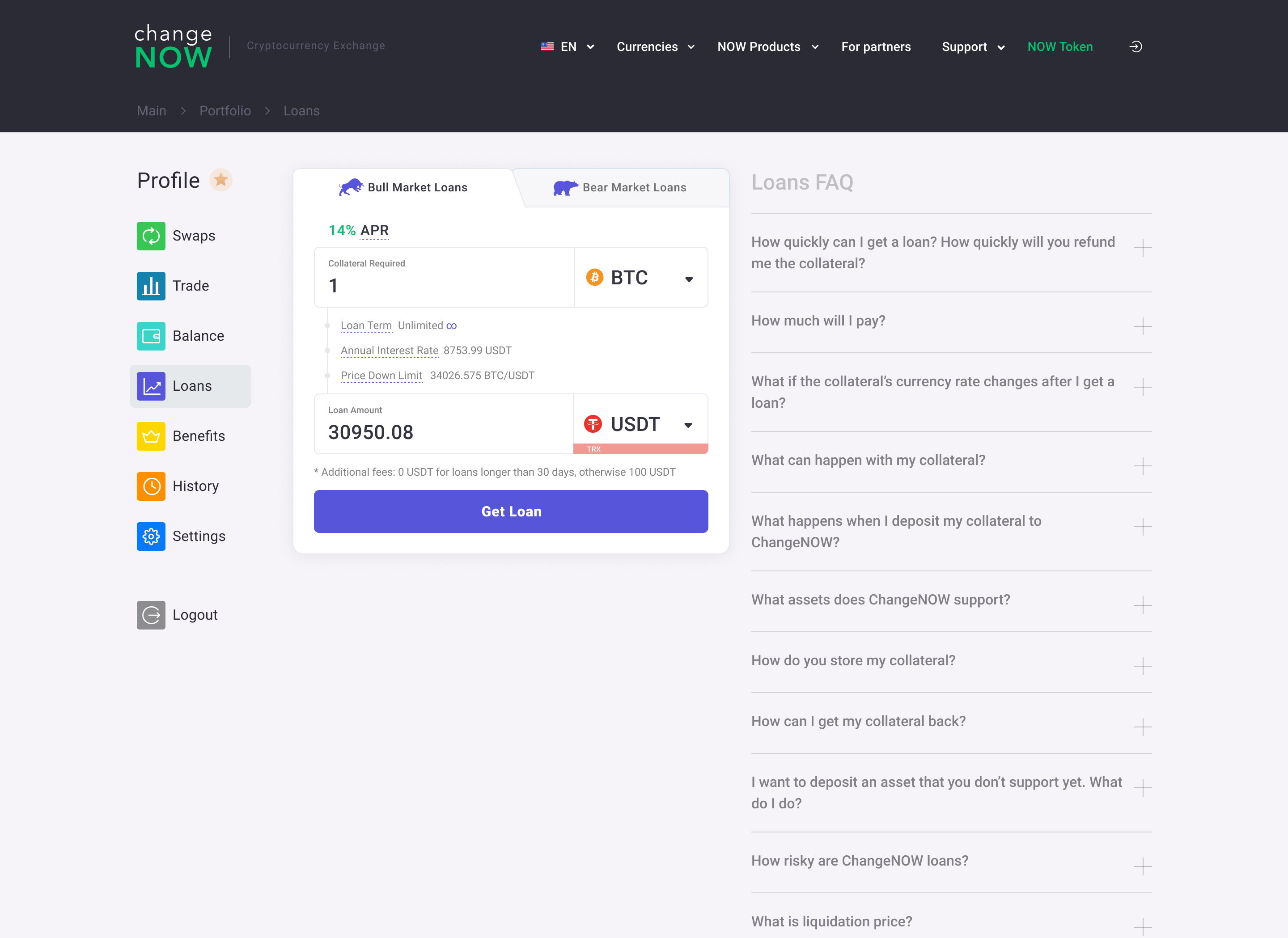

Take an instant crypto loan to make the most of your assets. Don’t fear the market volatility - saddle it up! NOWLoans is a sustainable, transparent, and secure cryptocurrency lending service.

Close your loan at any time – after a few hours, in a month or a year later.

The interest rate is accrued every month and paid when you close the loan.

All the funds are stored in unique wallets with monthly renewed private keys.

We’ve got a fixed 50% Loan-to-Value (LTV) and 10% Annual Percentage Rate (APR).

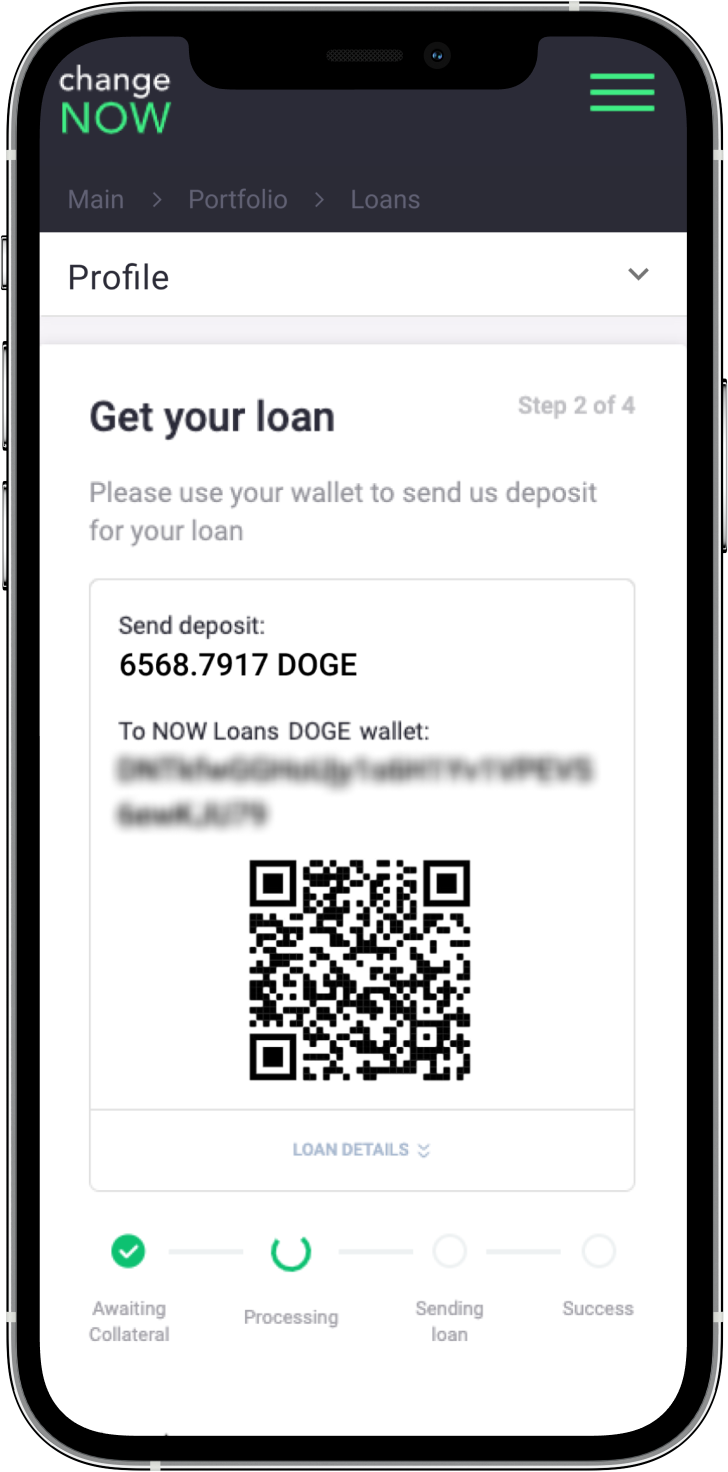

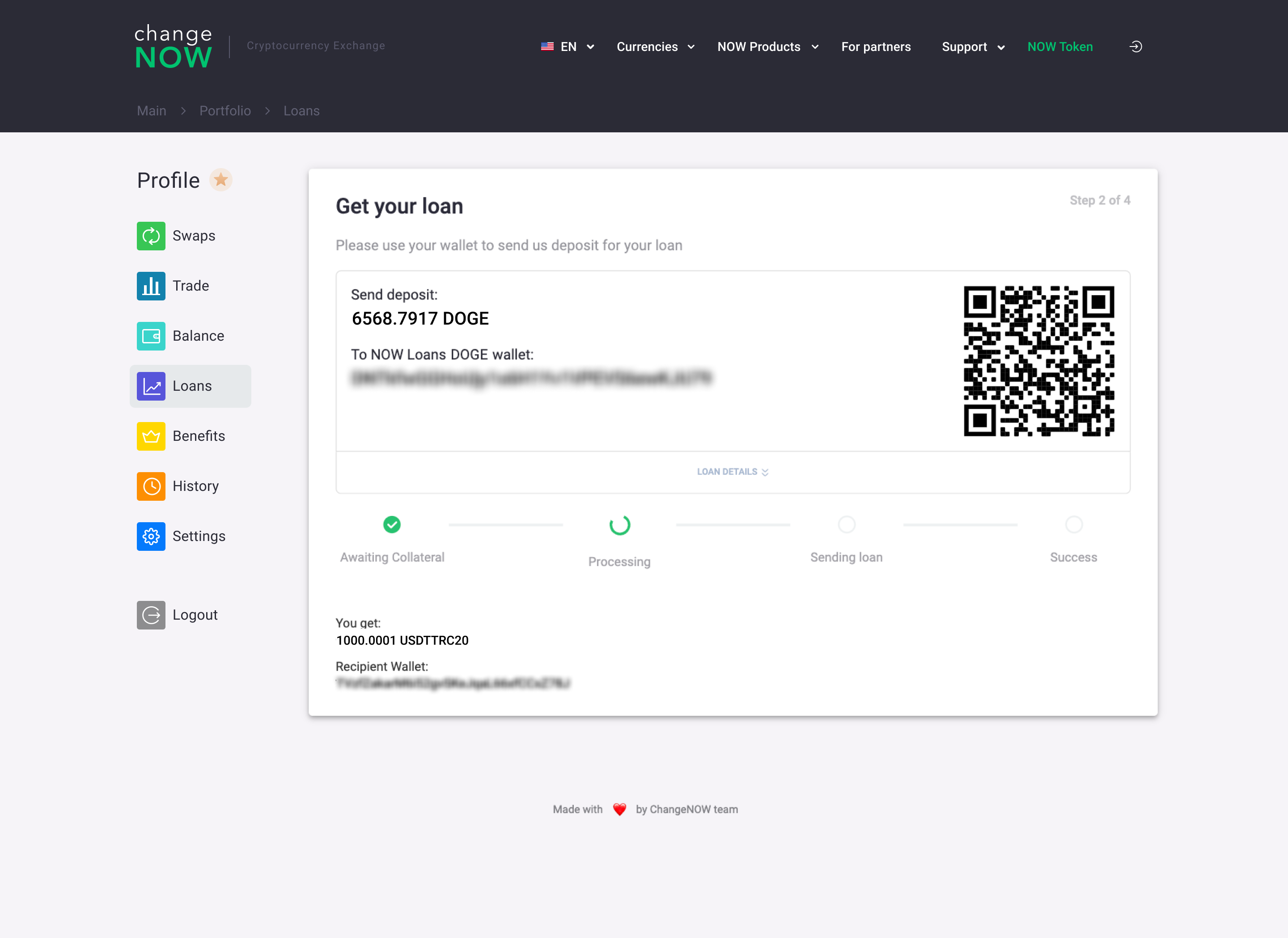

How crypto loans work

Make profit with crypto loans

NOWLoans helps you to profit from your crypto without selling it. It is a universal tool that works for you, no matter what`s happening on the market.

- You send 1 BTC as a deposit. Let’s say its price is $40,000

- You receive $20,000 USDT as a loan

- You buy another BTC for $20,000

- You hold the acquired BTC while it’s rising, until the moment you would like to fix your profit. Let’s assume a 30% growth in 4 months.

- You sell BTC for $26,000

- Then you buy your collateral out for $20,000 with $660 of APR

- You’ve got your BTC back with an additional profit of $5700