Instant crypto loan

Take an instant crypto loan to make the most of your assets. Don’t fear the market volatility - saddle it up! NOWLoans is a sustainable, transparent, and secure cryptocurrency lending service.

Close your loan at any time – after a few hours, in a month or a year later.

The interest rate is accrued every month and paid when you close the loan.

All the funds are stored in unique wallets with monthly renewed private keys.

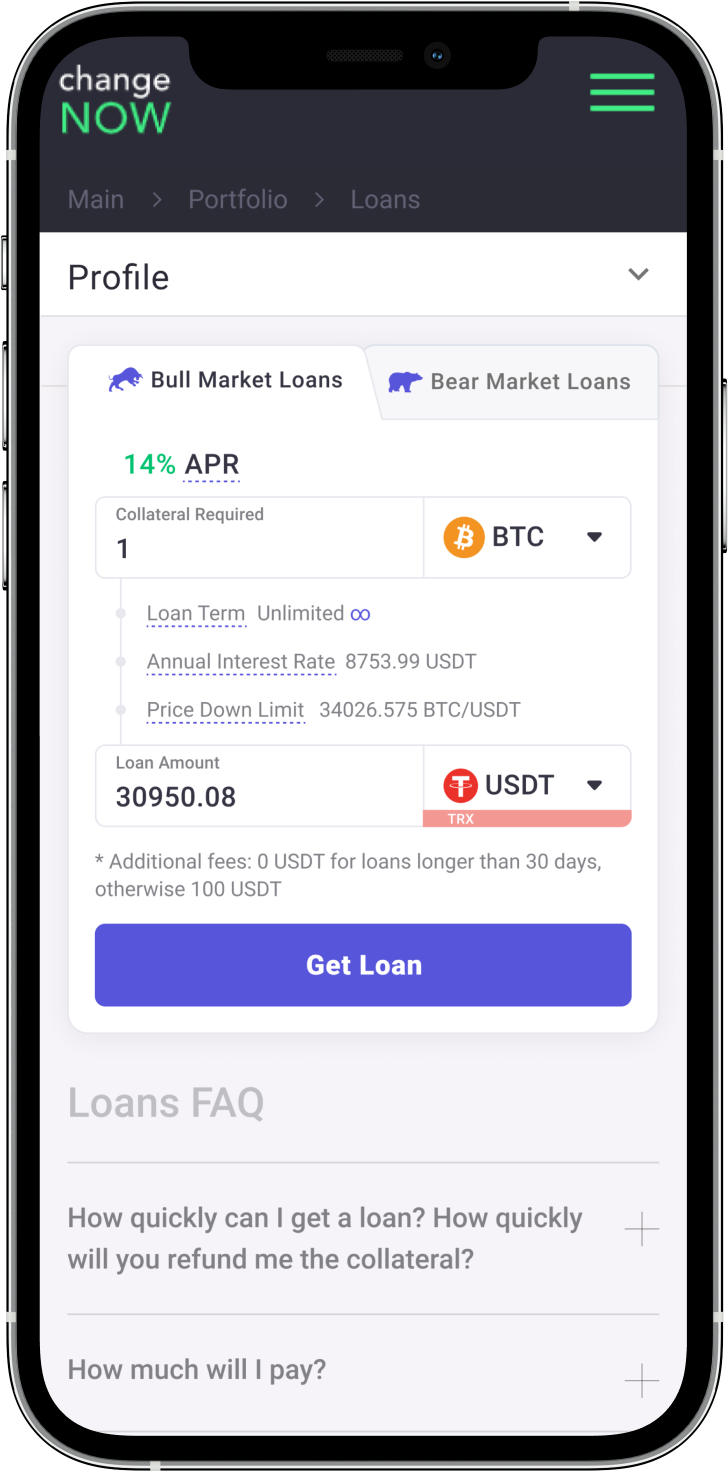

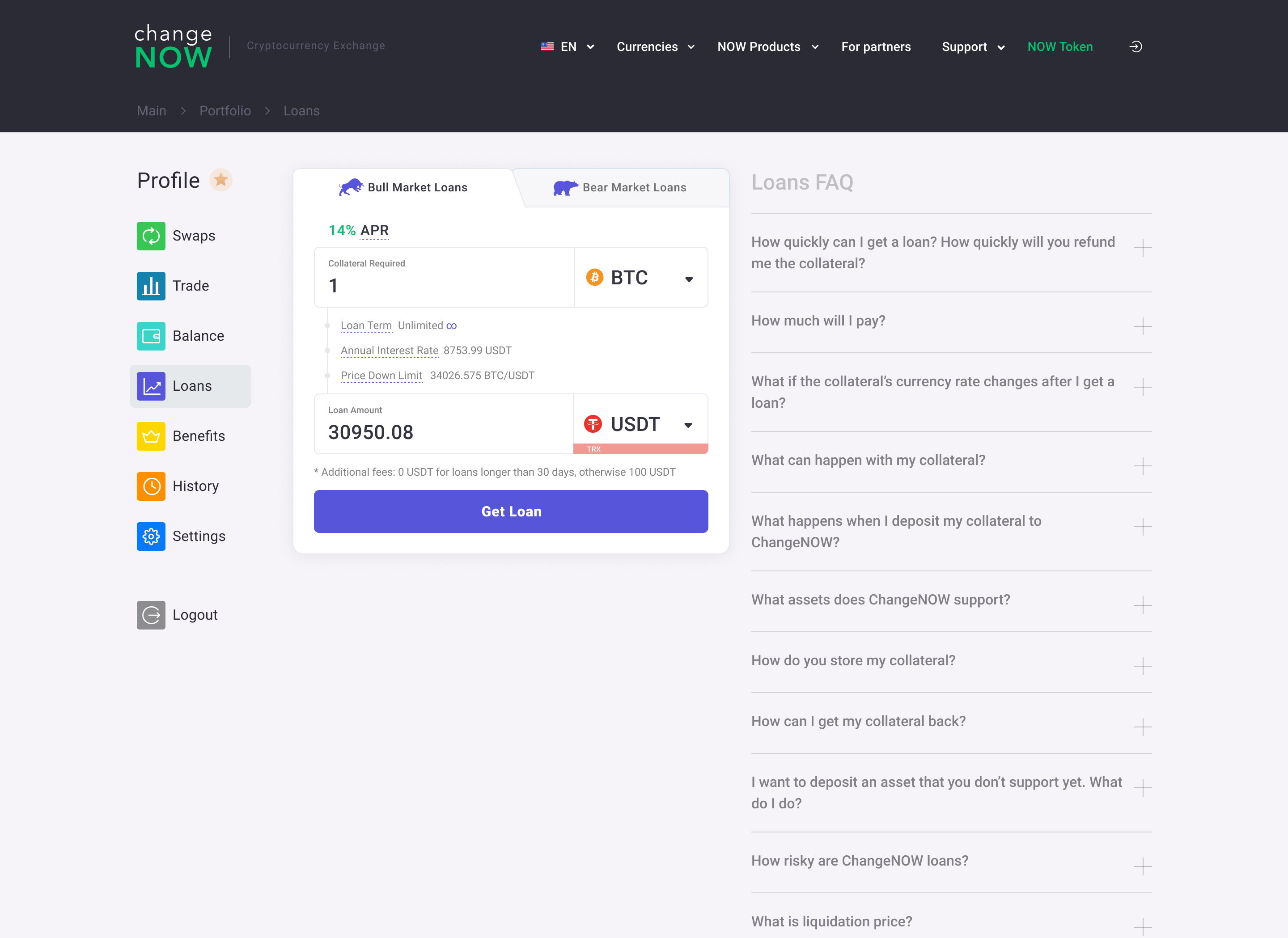

We’ve got a fixed 50% Loan-to-Value (LTV) and 10% Annual Percentage Rate (APR).

How crypto loans work

Make profit with crypto loans

NOWLoans helps you to profit from your crypto without selling it. It is a universal tool that works for you, no matter what`s happening on the market.

- You send 1 BTC as a deposit. Let’s say its price is $40,000

- You receive $20,000 USDT as a loan

- You buy another BTC for $20,000

- You hold the acquired BTC while it’s rising, until the moment you would like to fix your profit. Let’s assume a 30% growth in 4 months.

- You sell BTC for $26,000

- Then you buy your collateral out for $20,000 with $660 of APR

- You’ve got your BTC back with an additional profit of $5700

FAQ Loans

Collateral questions

What can happen with my collateral?

We carefully keep it under control for the whole period. Although, if the rate of the collateral currency reaches the liquidation level, the collateral will be automatically liquidated and the loan will be closed. It is impossible to return the collateral after liquidation – that’s why we will notify you multiple times when the current rate approaches the liquidation price.

What if the collateral’s currency rate changes after I get a loan?

The collateral’s currency rate doesn’t affect the amount of the loan buyback at the time of closing. You will receive the exact amount of collateral for the exact amount you loaned (+ accumulated APR)

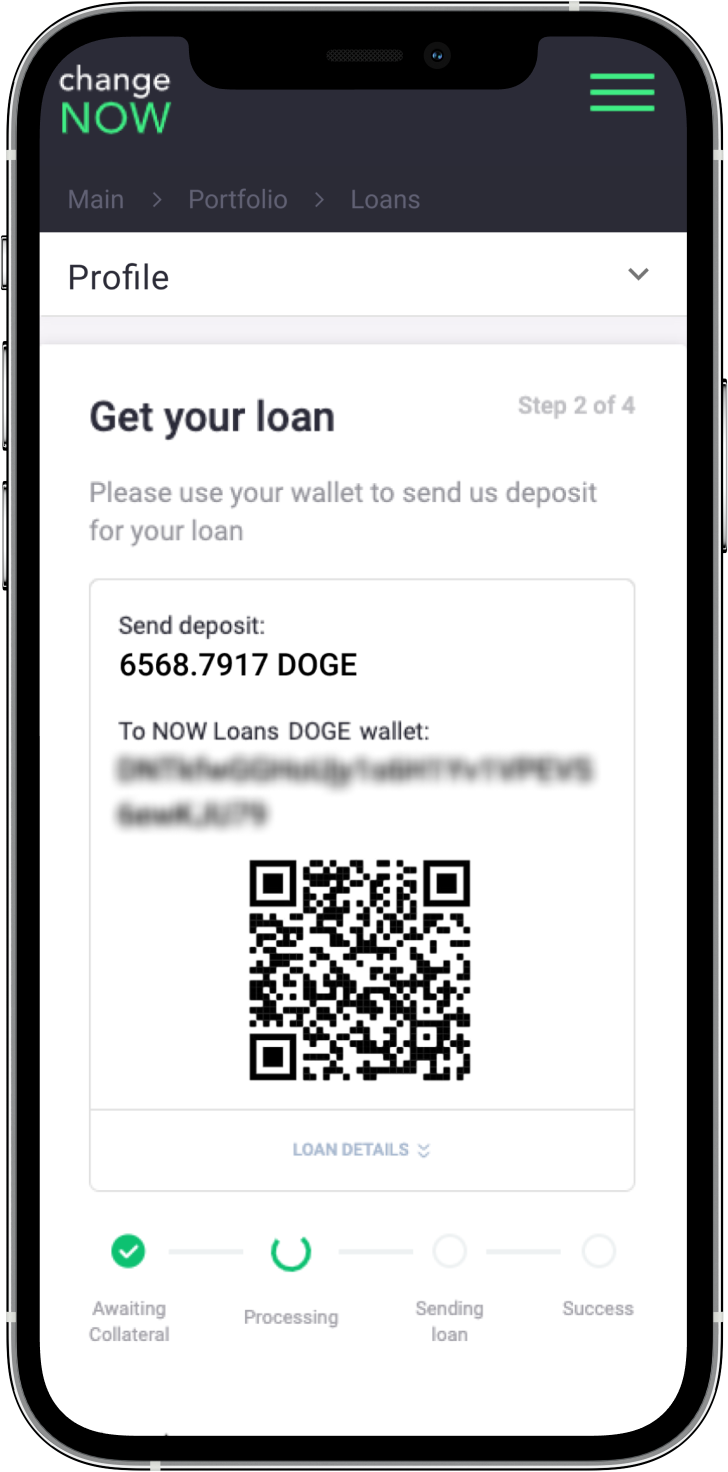

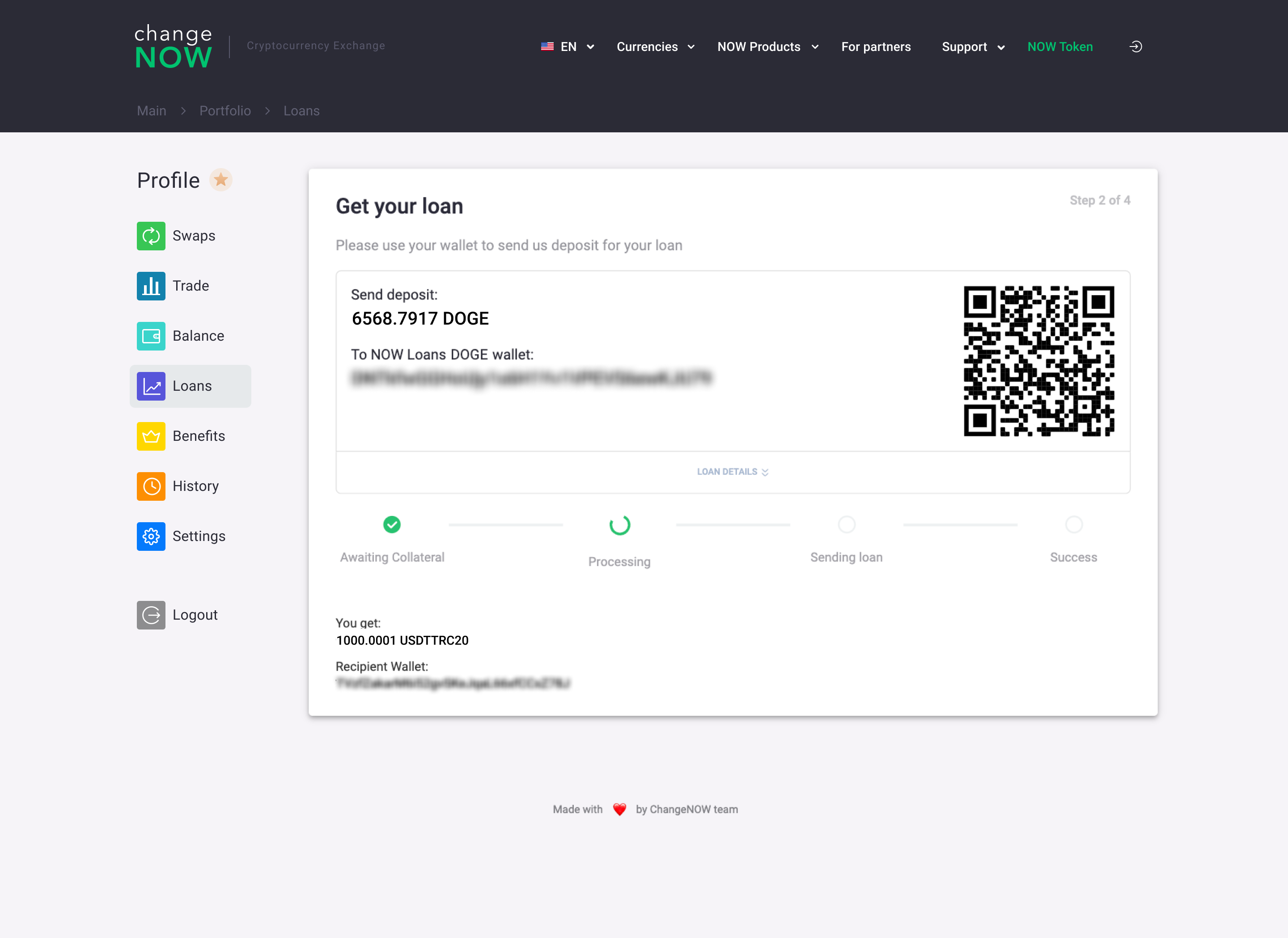

What happens when I deposit my collateral to ChangeNOW?

After your collateral deposit transaction is successfully confirmed, we process your funds through a risk management system. After the check, we initiate the loan payout transaction to the wallet you’ve entered when creating the loan. After your funds have reached you, your loan becomes active for as long as you’d like. All the APR you’ll accumulate is to be paid at the moment of collateral release.

How do you store my collateral?

All the funds are stored in special wallets, and private keys are put in secure storage that can be accessed only by several IP addresses and through a VPN connection. Private keys for all the wallets are renewed every month. The risk control system checks all wallets’ balances every second.

How can I get my collateral back?

You can get your collateral back anytime. To do that, you have to make your loan’s repayment. It consists of the amount loaned and the accumulated APR counted monthly during your loan period.

How is the collateral calculated?

We work at a 50% loan-to-value ratio: if your collateral is 1 Bitcoin and it costs $60,000, you will get $30,000 in Tether. Why only 50%? At the 50% LTV, we guarantee we don’t sell your collateral before its price drops by 50%. If our LTV were 90%, we would give you a $54k loan for your $60k, but if the Bitcoin price dropped to $54k, we’d sell it. This is not safe. Low LTV secures your collateral from liquidation.

What happens if the market goes up and my collateral is worth more?

When you repay the loan, we will return you the same amount of cryptocurrency as deposited. If your collateral size is 1 BTC, you will get back 1 BTC irrespective of its current market price. This is the fundamental value we provide: you can get some money now as a loan while your main long-term investment in crypto stays with you and keeps bringing you profits.

Loans terms

How quickly can I get a loan? How quickly will you refund me the collateral?

The average period of giving loans and releasing collaterals is 5-10 minutes, depending on how fast we receive your deposit.

The current state of the network and the network fee size can influence the period of us receiving collaterals. Make sure to set an appropriate network fee so that the transaction is confirmed as fast as possible.

How risky are loans?

You are to define your level of trust in the project. The service was launched with the support of Coin Rabbit, a company that has been known to be credible for years. If you need to make sure the service is safe and easy to use, you can always try it with small collateral. We are constantly taking steps to make the service more credible!

What is the liquidation price?

The liquidation price, or LP, is the collateral’s asset value at which we have to liquidate your loan. This amount is calculated due to us being able to compensate the issued loan if the collateral’s value drops in price significantly.

What are the limits for loans on your platform?

We don’t have a maximum cap for loans – our liquidity provider allows us to make sure you can loan as much as you’d like. Minimal loan amounts vary by currency, however, it’s more or less around $100.

Can I close my loan at any time?

Yes, there are no restrictions. You can close your loan in a month, a year, or even tomorrow and we’ll return your collateral with no questions. Note that for loans shorter than 30 days, there’s an extra closing $100 fee.

Can I have multiple loans?

Sure, you can have multiple loans with different or the same collateral. You will track them as separate loans. When it comes to the repayment, interest, and fees are charged for each loan separately.

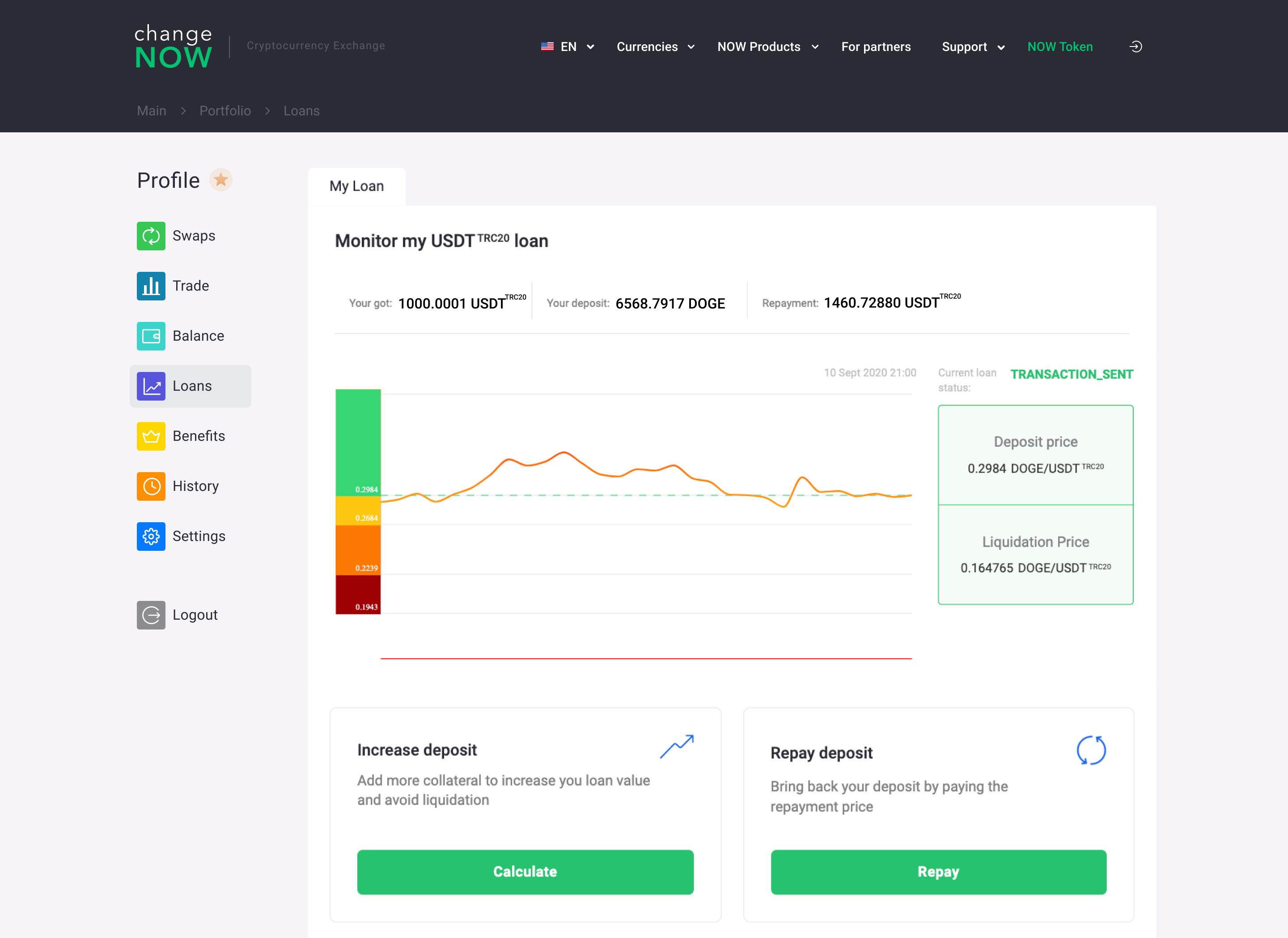

Where can I see the details about my loan(s)?

At the top of the page, click “Track my loan”. Sign in with your phone number and see your loan data: the size of your deposit and the loan, the repayment amount, and the price chart showing how far your collateral is from the liquidation price.

Rates, interests, and LTV

How much will I pay?

The annual rate of interest is 10%. The interest is calculated monthly and is included in the repayment amount.

What’s your LTV?

Our loan-to-value, or LTV, is set at 50% – that means that we give you 50% of the collateral value as a loan. This allows us to minimize your risks and protect you from the stark volatility of your collateral price.

We are open to your feedback about our LTV and are planning on adding an option to set your own LTV in the future.

I have a better rate offered by a competitor. Can you match it?

Our interest rate is one of the lowest on the market. More than that, there are no requirements to store our token to get better Loan conditions like many of our competitors do. All the conditions are transparent from the start. If you have thoughts on how we could offer you better service — feel free to contact our support 24/7. We will find a loan solution that fits you best.

Supported assets

What assets does ChangeNOW support?

We support several original coins for collateral deposits: BTC, ETH, BCH, NANO, DOGE, FIRO, XRP, and DGB, as well as several Ethereum tokens. For loans, you can receive either USDT or USDC. The list of available assets is constantly expanding, and more currencies are going to be supported soon.

I want to deposit an asset that you don’t support yet. What do I do?

We welcome any feedback on the product and suggestions from our customers. If you want us to add another asset to the list of the assets available for loans/collaterals, email us at [email protected] and we will do our best to add it ASAP.